Week Ahead March 18 – 22

EURUSD pair closed last week’s trading session lower on upbeat US Producer price index and stable German Harmonized index of consumer prices. The gap between the 2 indexes triggered higher demand in US Dollar as is adding pressure on FED to maintained interest rates unchanged for longer. Odds of no rate cut in the next two months jumped higher and kept the pair under pressure.

As for this week, traders and investors will mainly focus on the FOMC due to be released on Wednesday. No change in interest rates is expected at this meeting, although, the comments that will follow in the press conference and the projections of future interest rate will definitely generate some volatility in the pair. Given last week’s PPI we are expecting FED to remain hawkish and push the pair further on the downside.

On the economic calendar we have on Monday, the European Harmonized index of consumer prices to remain unchanged at 3.1% On Thursday, German composite PMI pointing higher at 46.8 European Services PMI higher at 50.5 and US Manufacturing PMI lower at 51.7 On Friday, US services PMI expected unchanged at 52.3

Technically the picture remains neutral after last week’s close below (61.8%) at 1.0885 In this week’s trading session if pair trades on the downside will test 1.0862 (50%) a break and close below this level will change the overall picture to negative and open the road for 1.0774 If trades on the upside will retest 1.0975 and if breaks and closes above (61.8%) will open the road for 1.1100 Our traders took profit their long positions at 1.0960 We are expecting new long positions at 1.0860 and new short positions at 1.1100

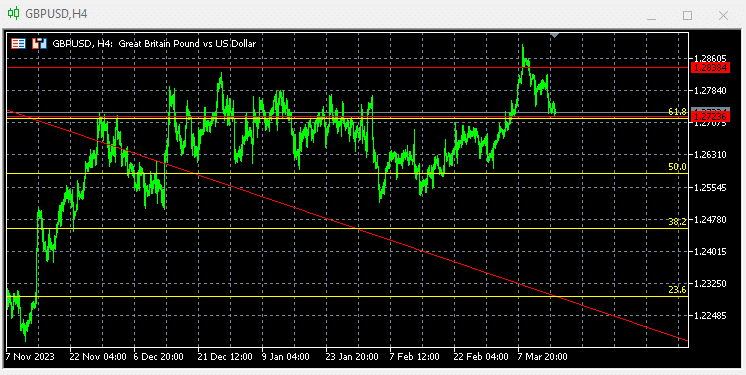

GBPUSD pair closed last week’s trading session lower on upbeat US Producer price index and higher than expected UK ILO Unemployment rate. The higher than expected US PPI triggered higher demand in US Dollar as is adding pressure on FED to maintained interest rates unchanged for longer. Odds of no rate cut in the next two months jumped higher and kept the pair under pressure.

As for this week, traders and investors will mainly focus on the FOMC due to be released on Wednesday and BOE interest rate decision due to be released on Thursday. No change in interest rates is expected at those meetings, although, the comments that will follow in the press conferences and the projections of future interest rates will definitely generate some volatility in the pair. Given last week’s PPI we are expecting FED to remain hawkish and push the pair further on the downside. Wednesday’s UK release on consumer price index will impact Thursday’s decision and traders need to closely follow the Wednesday’s CPI release.

On the economic calendar we have on Wednesday, UK CPI pointing higher at 0.7% On Thursday, UK Manufacturing PMI expected higher at 47.8 and composite PMI higher at 53.3 US Manufacturing PMI expected lower at 51.7 On Friday UK Gfk consumer confidence expected unchanged at -21 UK retail sales lower at -0.1 and US Services PMI unchanged at 52.3

Technically the pair’s overall picture is positive after last week’s close above (61.8%) at 1.2732 As for this week, if pair trades on the upside, will retest 1.2930 Alternative, if trades on the downside, will retest 1.2590 Our traders stay with short positions at 1.2723 and 1.2850 targeting profits at 1.2500. We are expecting more aggressive short sellers above 1.2900 targeting profits at 1.2500 and long positions at 1.2460

For more detailed economic calendar events please visit our live economic calendar on:

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. CFDs are leveraged products. CFD trading may not be suitable for everyone and can result in losing all your invested capital, so please make sure that you fully understand the risks involved.