Week Ahead April 15th – 19th

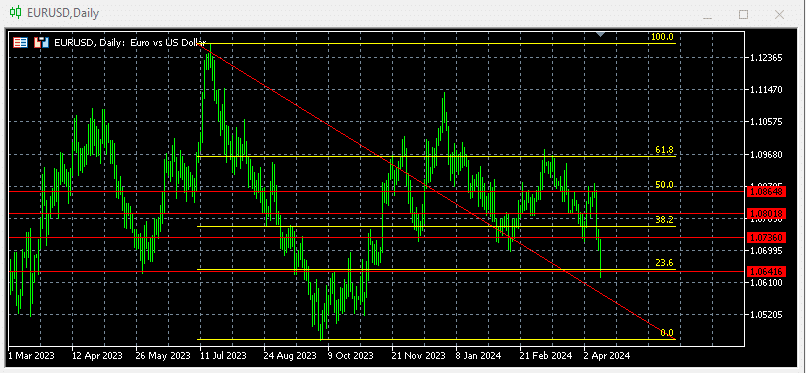

EURUSD pair closed last week’s trading session lower amid divergence between the FED and the ECB. FED during their last minutes released last Wednesday and after members comments is poised not to cut interest rates in 2024 given the recent pick in inflation. On the other hand, ECB maintained interest rates unchanged as it was widely expected, although, ECB’s members agree that rates reduction will be take place in 2024. Geopolitical tensions in the middle east and fear of Iran strikes against Israel boosted demand for safe heaven US Dollar and this weighted negative on the pair.

As for this week, traders and investors will mainly focus on the geopolitical tensions in the middle east region. The lack of any significant economic release will let the pair within technical levels. ECB and FED officials are due to speak out during the week and their comments could generate some volatility.

On the economic calendar we have on Monday, the US retail sales pointing lower at 0.3% On Wednesday, European Harmonized index of consumer prices expected to remain unchanged at 2.9%

Technically the picture is negative after last week’s close below (23.6%) at 1.0645 In this week’s trading session if pair trades on the downside will test 1.0562 If trades on the upside will retest 1.0766 Our traders open new long positions between 1.0863 and 1.0640 targeting profits at 1.0900 We are expecting more aggressive long positions on the way down and new short positions above 1.0900

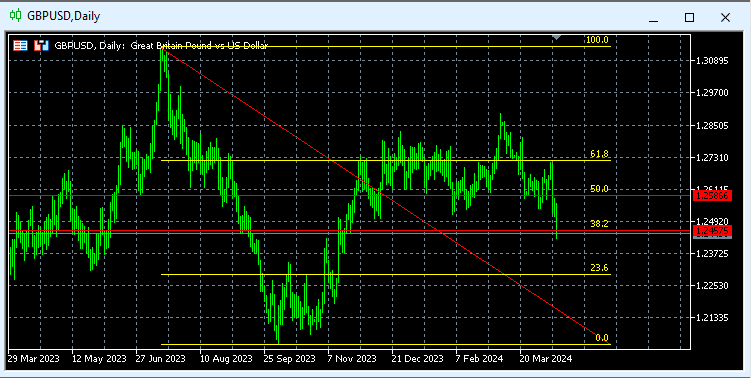

GBPUSD pair closed last week’s trading session lower amid Geopolitical tensions in the middle east and fear of Iran strikes against Israel that boosted demand for safe heaven US Dollar. Minutes from FOMC were taken as hawkish in the markets, after almost all FED members agree that it will not be any interest rate cut in 2024 and this weighted negative on the pair.

As for this week, traders and investors will mainly focus on the speech by BOE’s Governor Bailey. The speeches will send a clear signal on what the central bank’s path will be in the next meeting. Traders and investors will brace against geopolitical tensions in the middle east and a possible Iran strike against Israel that will lead to escalation.

On the economic calendar we have on Monday, the US retail sales pointing lower at 0.3% on Tuesday, UK ILO unemployment rate expected at 3.9% On Wednesday, UK consumer prices to remain unchanged at 4.5% and UK retail price index at 4.5% On Friday, UK retail sales to remain unchanged at 0%

Technically the pair’s overall picture is negative after last week’s close below (38.2%) at 1.2445 As for this week, if pair trades on the upside, will test 1.2586 (50%) Alternative, if trades on the downside, will test 1.2300 (23.6%) Our traders are long between 1.2566 and 1.2457 targeting profits above 1.2800 We are expecting more aggressive long positions on the way down and new short sellers above 1.2700 targeting profits at 1.2600

For more detailed economic calendar events please visit our live economic calendar on:

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. CFDs are leveraged products. CFD trading may not be suitable for everyone and can result in losing all your invested capital, so please make sure that you fully understand the risks involved.