Week Ahead April 8th – 13th

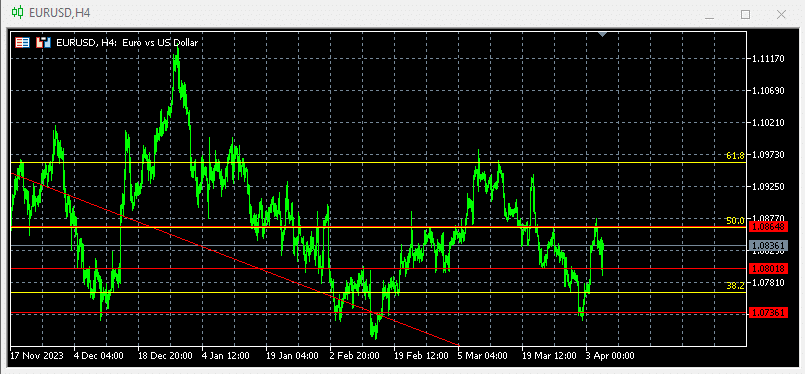

EURUSD pair closed last week’s trading session marginally higher after a choppy trading week. The upside move was due to traders and investors pre-position ahead of nonfarm payroll release. Although the upside was short-lived as hawkish comments from FED’s officials sent some doubts in the markets whether FED will be cutting rates this year. On the European side the CPI release came softer than expected and add downside pressure on the pair as now investors and traders are pricing in a more dovish stance from ECB.

As for this week, traders and investors will mainly focus on the FOMC minutes due to be released on Wednesday and ECB interest rate decision and press conference due to be released on Thursday. None of the central banks will change interest rates at his meeting. Although the comments from the press conference will guide investors and traders what the future interest rates path will be. US CPI will be the most important catalyst for this week.

On the economic calendar we have on Wednesday, the US CPI pointing higher at 3.4% on yearly basis and lower at 0.3% on monthly basis. On Thursday, US PPI expected higher at 2.3% On Friday, German Harmonized index of consumer prices expected to remain unchanged at 2.3% and US Michigan consumer sentiment lower at 79

Technically the picture is negative after last week’s close just above (38.2%) at 1.0835 In this week’s trading session if pair trades on the downside will test 1.0762 (38.2%) a break and close below this level will open the road for 1.0700 If trades on the upside will retest 1.0866 and if breaks and closes above (50%) will open the road for 1.0960 Our traders open new long positions between 1.0863 and 1.0736 targeting profits at 1.0900 We are expecting more aggressive long positions on the way down and new short positions above 1.0900

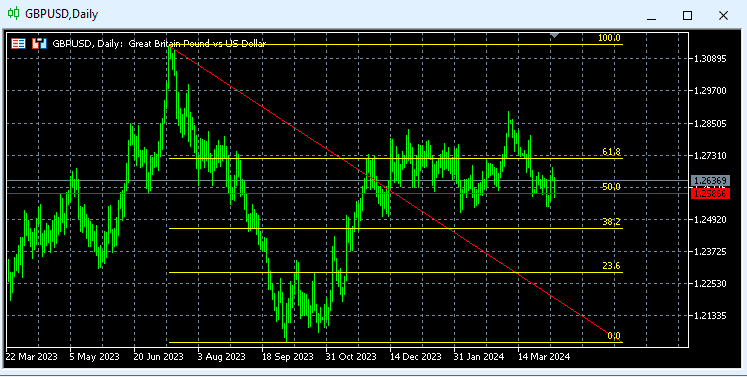

GBPUSD pair closed last week’s trading session marginally higher after a choppy trading week. The upside move was due to traders and investors pre-position ahead of nonfarm payroll release. Although the upside was short-lived as hawkish comments from FED’s officials sent some doubts in the markets whether FED will be cutting rates this year.

As for this week, traders and investors will mainly focus on the FOMC minutes due to be released on Wednesday. FED will change interest rates at his meeting. Although the comments from the press conference will guide investors and traders what the future interest rates path will be. US CPI will be the most important catalyst for this week.

On the economic calendar we have on Tuesday, the UK BRC like-for-like retail sales pointing at 1% on Wednesday, the US CPI pointing higher at 3.4% on yearly basis and lower at 0.3% on monthly basis. On Thursday, US PPI expected higher at 2.3% On Friday, UK gross domestic product expected lower at 0.1%, UK manufacturing production higher at 0.2% and US Michigan consumer sentiment lower at 79

Technically the pair’s overall picture is neutral after last week’s close just above (50%) at 1.2636 As for this week, if pair trades on the upside, will retest 1.2715 (61.8%) Alternative, if trades on the downside, will retest 1.2530 Our traders are long at 1.2566 targeting profits above 1.2800 We are expecting more aggressive long positions on the way down and new short sellers above 1.2700 targeting profits at 1.2600

For more detailed economic calendar events please visit our live economic calendar on:

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. CFDs are leveraged products. CFD trading may not be suitable for everyone and can result in losing all your invested capital, so please make sure that you fully understand the risks involved.