Week ahead September 19th – 23rd

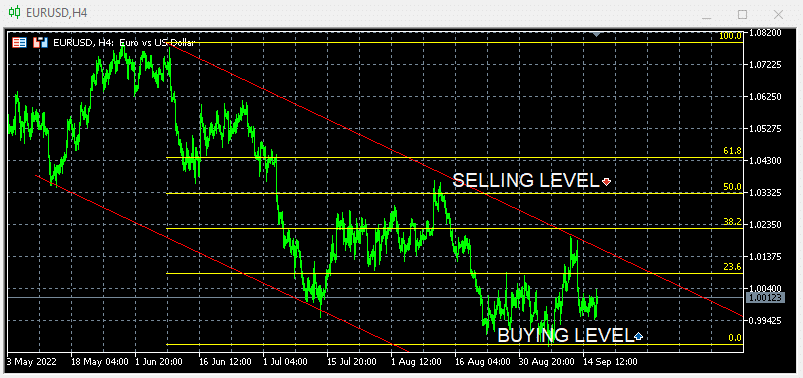

FONDAMENTAUX ET TECHNIQUES DE L'EUR/USD

Pair closed last week’s trading session unchanged after hovering around parity. The pair attempted to break lower on the surprising upbeat US inflation, although the downside was limited after the US retail sales disappointed traders and kept them on hold for the next economic indicators that will weigh on FED rate decision. From the EU side the rhetoric is still the same around rate hikes with many mixed comments from ECB officials.

As for this week market participants will mainly focus on the FOMC minutes and interest rate decision. Pair is already pricing in 0.75% rate hike on this meeting. If the FED will surprise with a 1% rate hike the pair will resume its downside momentum, as this will prove that the FED is willing to continue its aggressive monetary policy till inflation will go down to 2 -3%.

On the economic calendar, we have on Friday, German composite PMI pointing lower at 46 and European Composite PMI also lower at 48.2

Technically the picture is negative after last week’s closed below 23.6% In this week’s trading session if pair fails to resume upside move and turns down, will retest 0.9950, if breaks below 0.9950 will accelerate losses down to 0.9850. If pair manage to recover and close above (23.6%) could change the picture back to neutral and test next level of 1.0235 (38.2%). Our traders are net 100% long with positions opened between 1.0800 to 0.9900 targeting profits above 1.0800 In this week’s trading session we are expecting more aggressive long positions on the way down. Alternative if pair continues trading on the upside, we are expecting short sellers to appear around 1.0425 (61.8%)

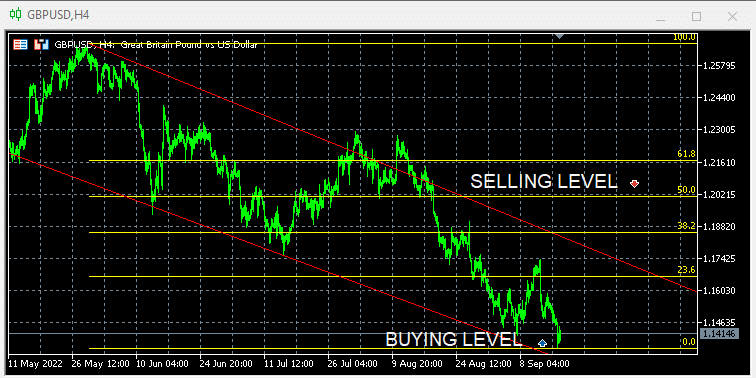

GBP/USD FONDAMENTAUX ET TECHNIQUES

Pair closed last week’s trading session lower on disappointing UK economic releases and on US surprisingly high inflation number that boosted possibilities of a full 1% rate hike on Wednesday’s FOMC. The high inflation in the UK is deteriorating the economic outlook of the country and this is weighing negative on GBP. On the other hand US dollar is becoming stronger as inflation is pushing the FED into more aggressive rate hike policy.

As for this week market participants will focus on both central bank’s meetings and rate hike decisions. From the FED side a rate hike of 0.75% is already priced-in. From the UK side a 0.5% rate hike is pending to be priced in and is taken negative by markets as is too small to save the pound. pending now for this pair’s traders is to understand from the this week’s central bank’s meetings the divergence between the two central banks, with the FED releasing its minutes on Wednesday and the BOE on Thursday.

On the economic calendar there are no high impact economic releases apart from the two central bank’s minutes.

Technically the pair is negative after last week’s new multi years lower registration. In this week’s trading session if pair manages to recover lost ground and close above 1.1650 (23.6%) we are expecting to test 1.1820 (38.2%) Alternatively if pair continues on the downside will retest 1.1350 A break below 0% could accelerate losses down to 1.1300 Our traders are net long 100% with positions opened between 1.2200 to 1.1400 targeting profits above 1.2200 We are expecting more aggressive buyers on the way down and short sellers to appear around 1.1880

Pour un calendrier économique plus détaillé, veuillez consulter notre calendrier économique en direct sur :

http://tentrade.com/economic-calendar/

*Le matériel ne contient pas d'offre ou de sollicitation pour une transaction sur des instruments financiers. TEN.TRADE décline toute responsabilité quant à l'utilisation qui pourrait être faite de ces commentaires et aux conséquences qui pourraient en résulter. Pas de représentation Aucune garantie n'est donnée quant à l'exactitude ou à l'exhaustivité de ces informations. Par conséquent, toute personne agissant sur la base de ces informations le fait entièrement à ses risques et périls. à leurs propres risques. Les CFD sont des produits à effet de levier. La négociation de CFD peut ne pas convenir à tout le monde et peut entraîner la perte de la totalité du capital investi ; assurez-vous donc de bien comprendre les risques encourus.

Vous devez vous connecter pour publier un commentaire.