Week Ahead June 24th – 28th

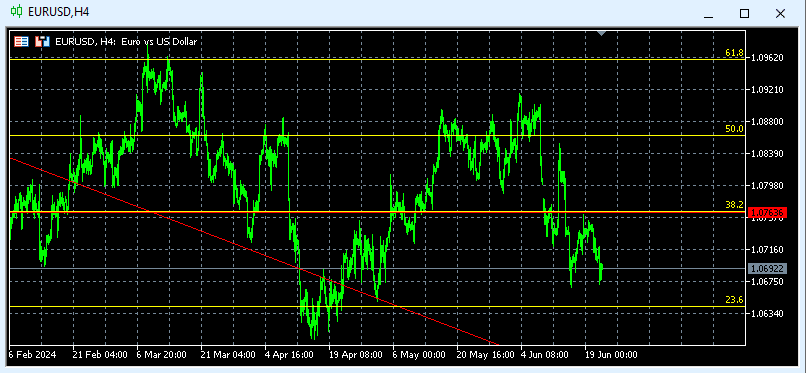

EURUSD pair closed last week’s trading session marginally lower after an attempt to break higher during the week. The steady European inflation overshadow from deteriorated European PMI and kept the pair unchanged looking for direction. The US PMI came out better than expectations although the pair did not suffer more losses.

As for this week, traders and investors will mainly focus on the US PCE index due to be released on Friday. The lack of any high impact economic releases will keep the pair trading within technical levels.

On the economic calendar we have on Thursday the US Gross domestic product expected at 1.3% On Friday, German retail sales expected at -0.6% and US personal consumption expenditure at 2.8%

Technically the picture is negative after last week’s close below (38.2%) at 1.0692 In this week’s trading session if pair trades on the upside will test 1.0764 If trades on the downside will test 1.0604 Our traders entered new long positions at 1.0764 targeting profits at 1.0900 we are expecting more aggressive long positions on the way down and short position above 1.0865

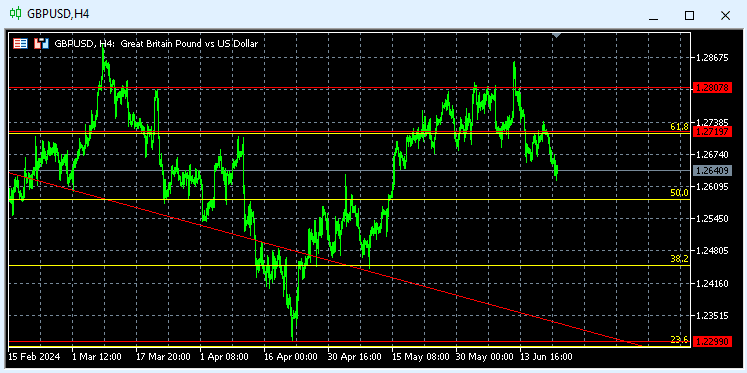

GBPUSD pair closed last week’s trading session lower on dovish comments from BOE. The central bank, maintained interest rates unchanged, although in the minutes released and during press conference BOE sent a strong clear signal in markets that they are too optimistic on inflation and could reduce interest rates in the next meeting. The dovish comments triggered a selloff in GBP and pushed the pair lower.

As for this week, traders and investors will mainly focus on the UK Gross domestic product and US PCE index. The light economic calendar will keep the pair trading within technical levels.

On the economic calendar we have on Thursday, the US Gross domestic product pointing at 1.3% on Friday, UK gross domestic product at 0.6% and US personal consumption expenditure at 2.8%

Technically the pair’s overall picture is neutral after last week’s close below (61.8%) at 1.2642 As for this week, if pair trades on the upside, will test 1.2870 Alternative, if trades on the downside, will test 1.2586 (50%) Our traders are standing with short positions at 1.2800 and 1.2720 targeting profits at 1.2600 we are expecting more aggressive short positions on the way up and new long positions below 1.2600

For more detailed economic calendar events please visit our live economic calendar on:

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. CFDs are leveraged products. CFD trading may not be suitable for everyone and can result in losing all your invested capital, so please make sure that you fully understand the risks involved.