Week ahead July 18th – 22nd

EUR/USD FUNDAMENTOS E TÉCNICOS

Pair closed last week’s trading session lower on renew US Dollar’s strength. The US dollar continues to gather strength as investors and traders are bracing for a 1% rate hike on the next FOMC. The better than expected economic releases last week boosted demand for US Dollar and this weighted negative on the pair. The pair attempted to break below parity, although some profit taking on short positions and stop losses on the long positions reversed the pair on the upside and retested 1.0100

As for this week market participants will mainly focus on the ECB’s rate decision, due to be released on Thursday. 0.25% rate hike is expected at this meeting. Traders and investors will be standby for this meeting and waiting to listen if the central bank will reverse their conservative policy and become more hawkish on an effort to stabilize EUR/USD exchange rate and fight inflation. The lack of any heavy economic release from the US will help the pair recover some lost ground, unless if, ECB will failed to deliver a more hawkish release.

On the economic calendar, we have on Tuesday, the European HICP, expected to remain unchanged at 3.7% On Wednesday, German producer price index expected lower at 1%. European consumer confidence lower at -25. On Thursday, ECB rate decision expected to confirm a rate hike of 0.25% following by the press conference. On Friday, German Composite PMI expected lower at 50.1 Manufacturing PMI lower at 50.6 European services PMI lower at 51, later in the US, composite PMI expected lower at 51.7 Manufacturing PMI lower at 52.5 and services PMI lower at 52.1

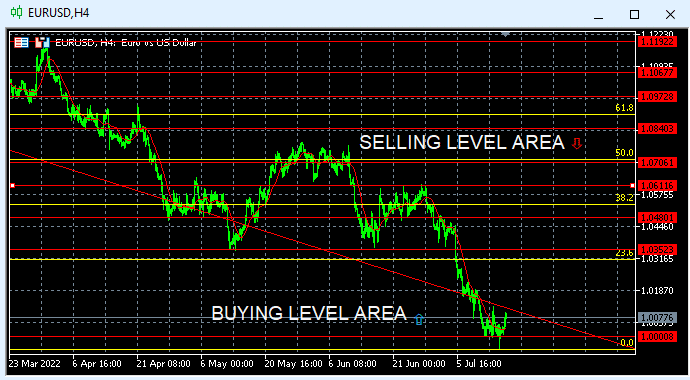

Technically the picture is negative after last week’s closed lower and registering a 20 year lower level. In this week’s trading session if pair breaks below 1.0000 will accelerate losses down to 0.9900. If pair manage to recover and close above (23.6%) could change the picture back to neutral and test next level of 1.0530 (38.2%). Our traders are net 100% long with positions opened between 1.1350 to 1.0000 targeting profits above 1.1350 we are expecting more aggressive long positions on the way down. Alternative if pair continues trading on the upside, we are expecting short sellers to appear around 1.0530 (38.2%)

GBP/USD FUNDAMENTOS E TÉCNICOS

Pair closed last week’s trading session lower on stronger US Dollar. The better than expected economic releases in the US, boosted the demand for US Dollar as investors and traders are bracing for a 1% rate hike on the next FOMC. Pair managed to recover some lost ground by the end of the week after some short sellers took profit and long positions hit stop losses.

As for this week market participants will focus on the heavy economic calendar in the UK. All eyes will be on the Inflation number in the UK. The lack of any high impact economic releases in the US will give the chance to the pair to recover some lost ground.

On the economic calendar we have on Tuesday, UK ILO unemployment rate to remain unchanged at 3.8% On Wednesday, consumer price index expected higher at 9.3% and retail price index higher at 12.8% On Friday Gfk consumer confidence lower at -42, retail sales lower at -5.3%, Services PMI lower at 53.2. Later in the US, composite PMI expected lower at 51.7, Manufacturing PMI lower at 52.5 and services PMI lower at 52.1

Technically the pair is negative after last week’s close on new lower level seen back in BREXIT fever. In this week’s trading session if pair manages to recover on the upside, we are expecting to test 1.2210 (23.6%) Alternatively if pair continues on the downside and break below 0% could accelerate losses down to 1.1700 Our traders are net long 100% with positions opened between 1.3412 to 1.1950 targeting profits above 1.3400 We are expecting more aggressive buyers on the way down and short sellers to appear around 1.2625

Para eventos mais detalhados do calendário econômico, por favor, visite nosso calendário econômico ao vivo em:

http://tentrade.com/economic-calendar/

*O material não contém uma oferta ou solicitação de uma transação em nenhum instrumento financeiro. A TEN.TRADE não se responsabiliza por qualquer uso que possa ser feito desses comentários e por quaisquer conseqüências que daí possam resultar. Sem representação ou a garantia é dada quanto à precisão ou completude destas informações. Conseqüentemente, qualquer pessoa agindo sobre ela o faz inteiramente em seu próprio risco. Os CFDs são produtos alavancados. A negociação de CFDs pode não ser adequada para todos e pode resultar na perda de todo o seu capital investido, portanto, por favor, certifique-se de compreender plenamente os riscos envolvidos.

Você precisa fazer o login para publicar um comentário.