Week ahead September 26th – 30th

EUR/USD FUNDAMENTOS E TÉCNICOS

Pair closed last week’s trading session lower registering a multi decade new low. The pair suffered huge selling pressure on FED’s rate hike of 0.75% that was accompanied by better than expected US economic releases. On the other side the Euro is getting into trouble as the energy crisis deepens and Russia adding nuclear threads against the EU. It looks like the Euro is entering into an oversold territory without end. The economic releases are so badly deteriorated that signals of recession are becoming stronger and stronger every week.

As for this week market participants will mainly focus on many speeches during the week from both ECB’s Christine Laggard and FED’s Jerome Powell. Both banks are in the same fight against inflation. Although the ECB is facing a strong front wind, the recession, and this is keeping the central bank more careful on its rate hike decisions. On the other side the FED can do more rate hikes of 0.25% each without affecting negative the US economy. Geopolitical turmoil will be the major element that will create more downside pressure on Euro as Russia is poised to annex three Ukraine states this week. That means, if Ukraine will try to attack a Russian territory, Russia could use nuclear weapons on Ukraine and situation will get out of control in Europe.

On the economic calendar, we have on Monday, German IFO business climate pointing lower at 87.1 On Tuesday, US durable goods orders expected lower at -1.1% On Thursday, German Harmonized index of consumer prices expected higher at 9.8% and US gross domestic product to remain unchanged at -0.6% On Friday, German retail sales expected lower at -5.1% European HICP to remain unchanged at 9.1% and US Michigan consumer sentiment unchanged at 59.5

Technically the picture is negative after last week’s closed below 23.6% In this week’s trading session if pair fails to resume upside move and continues on the downside , will accelerate losses down to 0.9550. If pair manage to recover and close above (23.6%) could change the picture back to neutral and test next level of 1.0118 (38.2%). Our traders have stopped out all long positions after the pair broke below 0.9880 and now they are sitting on the side and waiting for new levels to enter. We are expecting new buyers around 0.9500 alternative if pair resumes upside we are expecting short sellers to appear at 1.0118

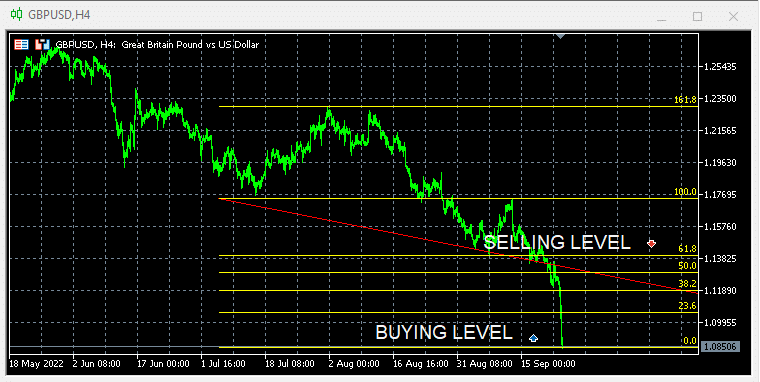

GBP/USD FUNDAMENTOS E TÉCNICOS

Pair closed last week’s trading session on extremely lower level never seen before. The FED hike rates by 0.75% and in combination with the better than expected economic releases from the US added more downside pressure to the pair. On the other side the BOE failed to deliver what market was expected. The 0.5% rate hike with the negative comments of BOE’s governor, confirming that the UK economy is officially in recession, was more than enough to accelerate losses.

As for this week market participants will focus on both central bank’s speeches. Traders should follow carefully what the central banks have to say and gather more information on the UK recession and how the central banks are planning to fight inflation while in the same time should avoid worsening their economic outlook.

On the economic calendar we have on Tuesday, US durable goods orders with expectations to be lower at -1.1% On Thursday, US gross domestic product to remain unchanged at -0.6% On Friday, UK gross domestic product to remain unchanged at -0.1 and US Michigan consumer sentiment unchanged at 59.5

Technically the pair is negative after last week’s new multi years lower registration. In this week’s trading session if pair manages to recover lost ground and close above 1.1050 (23.6%) we are expecting to test 1.1820 (38.2%) Alternatively a break below 0% could accelerate losses down to 1.0700 Our traders have stop out all their long positions after broke below 1.1300 and now are sitting on the side waiting for new levels. We are expecting new buyers at 1.0800 and short sellers at 1.1800

Para eventos mais detalhados do calendário econômico, por favor, visite nosso calendário econômico ao vivo em:

http://tentrade.com/economic-calendar/

*O material não contém uma oferta ou solicitação de uma transação em nenhum instrumento financeiro. A TEN.TRADE não se responsabiliza por qualquer uso que possa ser feito desses comentários e por quaisquer conseqüências que daí possam resultar. Sem representação ou a garantia é dada quanto à precisão ou completude destas informações. Conseqüentemente, qualquer pessoa agindo sobre ela o faz inteiramente em seu próprio risco. Os CFDs são produtos alavancados. A negociação de CFDs pode não ser adequada para todos e pode resultar na perda de todo o seu capital investido, portanto, por favor, certifique-se de compreender plenamente os riscos envolvidos.

Você precisa fazer o login para publicar um comentário.