Week ahead November 7th – 11th

EUR/USD FUNDAMENTOS E TÉCNICOS

Pair closed last week’s trading session unchanged after a high volatile weekly session. The FED increased rates by 0.75% as it was widely expected and this had limited impact on the pair. Initial reaction was a downside move but not long lived. The speech conference of FED’s chairman, Jerome Powell, was taken negative by markets and triggered a selloff in the US dollar that helped the pair recover all lost ground all the way during the end of the week. FED has announced the end of its aggressive rate hike policy highlighted that any future rate hikes will be limited and in line with the inflation stability. On the other hand, ECB’s president Christine Lagarde comments, were taken as hawkish by markets, as she highlighted that the central bank will be detached from FED’s policy and will continue its rate hike policy until inflation will come back to its normal levels and exchange rate of EURUSD will be closely monetary.

As for this week market participants will mainly focus on the economic calendar releases with the main ones in focus the retail sales and the inflation numbers. The lack of any high impact central banks’ releases will keep this week’s session more over on the truck of last week’s momentum. Few central banks’ officials are due to speak during the week, although, the impact of their speech will be limited.

No calendário econômico, temos, na terça-feira, as vendas no varejo europeu apontando para -1,3%. Na quinta-feira, o índice de preços ao consumidor dos EUA deverá ser menor, em 6,5%. Na sexta-feira, o índice harmonizado alemão de preços ao consumidor permanecerá inalterado em 11.6% e o sentimento de consumo dos EUA de Michigan será menor em 59

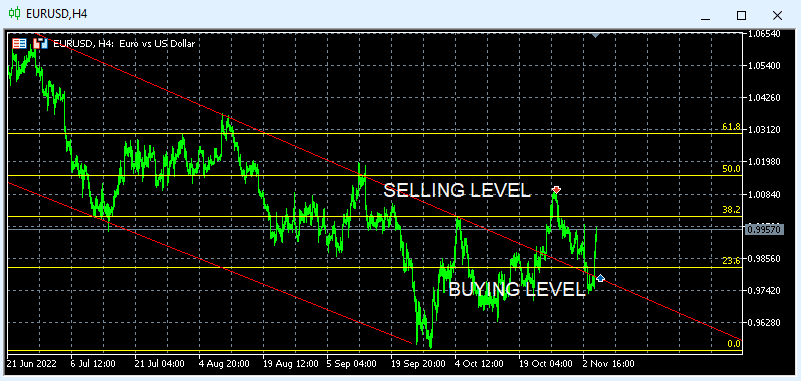

Technically the picture is neutral to positive after last week’s close below 38.2% with the rejection of 23.6% and reversal above the technical downtrend channel. In this week’s trading session if pair continues on the upside and close above (38.2%) could change the picture to positive and re-test next level of 1.0160 (50%). Alternatively, if pair resumes the downside we are expecting to retest last low of 0.9750 just below (23.6%). Buyers are now standing firm around 0.9850 targeting profits at 1.0300 Short sellers are still open at 1.0030 targeting profits at 0.9550 and we are expecting more sellers around 1.0180 (50%) and more aggressive buyers below 0.9750

GBP/USD FUNDAMENTOS E TÉCNICOS

Pair closed last week’s trading session lower on disappointing comments from BOE’s Governor, during his press conference. Even though the central bank increased rates by 0.75% as it was widely expected, the pair took it all the way down as the central bank projected a 3-year recession in the UK. The downside move, managed to stop b the end of the week and the pair recovered some lost ground as investors are flee out of the US Dollar due to FED’s U-Turn future policy on rate hikes. FED has announced the end of its aggressive rate hike policy highlighted that any future rate hikes will be limited and in line with the inflation stability.

As for this week market participants will focus on the economic calendar releases mainly the US CPI and UK Gross domestic. Few FED’s and BOE’s officials are due to speak during the week although the impact is expected to be very low.

On the economic calendar we have on Tuesday, UK BRC retail sales lower at 1.5% On Thursday US Consumer price index expected lower at 6.5% On Friday, UK Gross domestic product expected lower at -0.5% UK Manufacturing production lower at -6.6% and US Michigan consumer sentiment lower at 59

Technically the pair is positive as the pair closed above 61.8% for a second week on a row. In this week’s trading session if pair manages to continue on the upside, will keep the overall picture positive and could open the road to full recovery up to 1.1900 Alternatively a reversal on the downside and a break below (61.8%) could retest 1.1150 (50%) Buyers at standing firm around 1.1350 targeting profits around 1.1900 we are expecting short sellers to appear above 1.1600 targeting profits around 1.1150

Para eventos mais detalhados do calendário econômico, por favor, visite nosso calendário econômico ao vivo em:

https://tentrade.com/economic-calendar/

*O material não contém uma oferta ou solicitação de uma transação em nenhum instrumento financeiro. A TEN.TRADE não se responsabiliza por qualquer uso que possa ser feito desses comentários e por quaisquer conseqüências que daí possam resultar. Sem representação ou a garantia é dada quanto à precisão ou completude destas informações. Conseqüentemente, qualquer pessoa agindo sobre ela o faz inteiramente em seu próprio risco. Os CFDs são produtos alavancados. A negociação de CFDs pode não ser adequada para todos e pode resultar na perda de todo o seu capital investido, portanto, por favor, certifique-se de compreender plenamente os riscos envolvidos.