Settimana successiva dal 17 al 21 ottobre

FONDAMENTALI E TECNICI DELL'EUR/USD

Pair closed last week’s trading session unchanged after hovering around the same technical levels on the upside and downside, FED has maintained it policy unchanged as it was widely expected. Geopolitical and economic situation in the EU continues to be the same as Russia-EU relations continues to deteriorating and increasing the fears or escalation. In the same time as we are getting close to winter the gas and in general the energy crisis is deepening and testing EU consumers with higher prices in basic goods.

As for this week market participants will mainly focus on the geopolitical tensions and on the light economic calendar with more attention to be given on the inflation numbers. Few speeches from FED’s officials will be followed during the week, although we do not expect any extraordinary move in the pair given that the week will flow as easy as last week.

Per quanto riguarda il calendario economico, martedì il sentimento economico europeo ZEW punta al ribasso a -60,6 Mercoledì l'IPCA europeo dovrebbe rimanere invariato a 1,2% Giovedì l'indice dei prezzi alla produzione tedesco dovrebbe scendere a 1,3% Venerdì la fiducia dei consumatori europei scende a -30,3

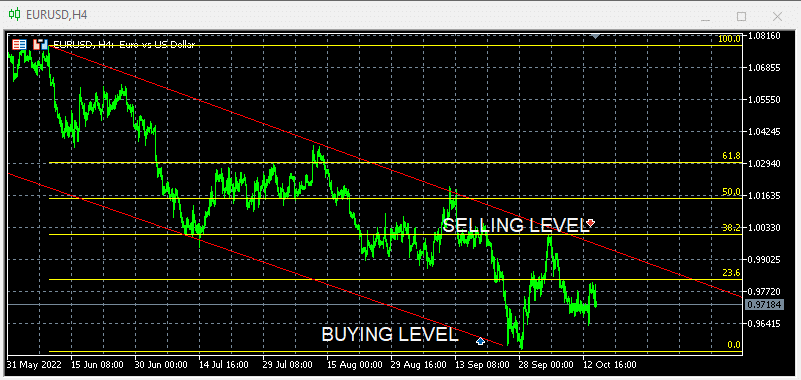

Technically the picture is negative after last week’s close below 23.6% In this week’s trading session if pair resumes upside and close above (23.6%) could change the picture back to neutral and re-test next level of 1.0030 (38.2%). Alternatively, if pair continues downside we are expecting to retest last low of 0.9550 (0%) We are expecting new buyers at 0.9550 targeting profits at 1.0000 Short sellers are still open at 1.0030 targeting profits at 0.9550

FONDAMENTALI E TECNICI DI GBP/USD

Pair closed last week’s trading session higher compare to last week’s trading session, although weekly session closed lower on PM’s Liz Truss U-turn on taxation and mini-budget. The inter-governmental turmoil begun after Thursday’s PM’s decision to dismiss chancellor Kwasi. Both events have weighted negative on Pound and resulted to downside move by the end of the week.

As for this week market participants will focus on the UK’s new chancellor Jeremy Hunt and how he will fix the mess around government’s mini-budget and tax cancellation. The budget proposed is leaving government with a hole of 25 billion pounds and chancellor need to explain what is the government’s plan to fund this hole.

Il calendario economico prevede per mercoledì l'indice dei prezzi al consumo in aumento a 10% e l'indice dei prezzi al dettaglio in aumento a 12,4%. Venerdì, la fiducia dei consumatori Gfk è prevista in calo a -52 e le vendite al dettaglio sono marginalmente migliori ma ancora negative a -5%.

Technically the pair is positive as the pair closed above 50% level at 1.1174. In this week’s trading session if pair manages to resume recovery and close above 1.1273 (61.8%) will keep the overall picture positive and could open the road to full recovery up to 1.1900 Alternatively a break below 50% could accelerate losses down to 1.0900 We are expecting new buyers at 1.0700 and short sellers at 1.1800

Per un calendario economico più dettagliato, visitate il nostro calendario economico in tempo reale su:

https://tentrade.com/economic-calendar/

*Il materiale non contiene un'offerta o una sollecitazione a effettuare transazioni su strumenti finanziari. TEN.TRADE non si assume alcuna responsabilità per l'uso che può essere fatto di questi commenti e per le conseguenze che ne derivano. Nessuna rappresentanza non viene fornita alcuna garanzia circa l'accuratezza o la completezza di queste informazioni. Di conseguenza, chiunque agisca in base ad esse lo fa a totale rischio e pericolo. il proprio rischio. I CFD sono prodotti con leva finanziaria. Il trading con i CFD può non essere adatto a tutti e può comportare la perdita dell'intero capitale investito, pertanto è bene accertarsi di aver compreso appieno i rischi connessi.