Week ahead September 12th – 16th

FONDAMENTAUX ET TECHNIQUES DE L'EUR/USD

Pair closed last week’s trading session marginally higher after recovering some lost ground from the dovish comments of ECB’s president Lagarde. The ECB increased rates by 0.75% on last week’s meeting, although, the comments from Christine Lagarde, saying that, it was premature to hike rates, were taken negative from markets and brought the pair lower. Few ECB’s officials save the currency after their hawkish comments that overshadowed Lagarde’s comments. ECB’s officials are highlighted that more rates will follow until inflation will come to its normal levels. This helped the pair to recover and close just on its crucial level of farther recovering.

As for this week market participants will mainly focus on the Inflation numbers from both continents. As both central banks are now focusing on inflation and energy crisis, the rest of economic releases will be having lower impact for now. Speeches from ECB’s officials are something to be monitor for clues of what’s next in the ECB. Price cap on Russian oil products is one of the most important decisions the EU is going to take as Russia is threatening to completely closing down any energy products supply to EU, something that will bring EU into chaos and most probable recession. Such scenario will have huge negative impact on Euro and could bring the pair into new lows.

On the economic calendar, we have on Tuesday, German Harmonized index of consumer prices to remain unchanged at 8.8% US Consumer price index expected higher at 6% On Thursday, US retail sales to remain unchanged at 0% On Thursday, US retail sales to remain unchanged at 0% On Friday, US Michigan consumer sentiment higher at 59.8

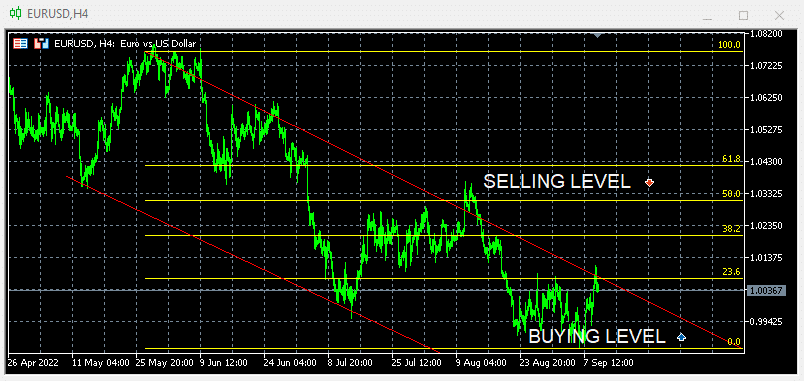

Technically the picture is negative after last week’s closed below 23.6% In this week’s trading session if pair fails to resume upside move and turns down, will retest 0.9950, if breaks below 0.9950 will accelerate losses down to 0.9850. If pair manage to recover and close above (23.6%) could change the picture back to neutral and test next level of 1.0200 (38.2%). Our traders are net 100% long with positions opened between 1.0800 to 0.9900 targeting profits above 1.0800 In this week’s trading session we are expecting more aggressive long positions on the way down. Alternative if pair continues trading on the upside, we are expecting short sellers to appear around 1.0425 (61.8%)

GBP/USD FONDAMENTAUX ET TECHNIQUES

Pair closed last week’s trading session higher on UK’s new PM Liz Truss energy plan. As per her promises, she is planning to help households on energy bills and reduce the bills to no more than 2,500 pounds per year for a normal size household. In addition to the above, pound had time for relief last week as there were not any high impact economic releases from the US.

As for this week market participants will focus on the inflation numbers and the economic releases from both sides. The better than expected inflation number in the US will add downside pressure on the pair as traders will start pricing in a new rate hike in September. From the UK point of view the plans of new PM will be well applause from market participants especially the ones focusing on controlling energy crisis.

On the economic calendar we have on Monday the UK manufacturing production pointing higher at 1.7% On Tuesday, UK ILO unemployment rate to remain unchanged at 3.8% and US Consumer price index higher at 6% On Wednesday, UK consumer price index expected higher at 10.2% On Thursday US retail sales to remain unchanged at 0% On Friday, UK Retail sales are pointing lower at -0.6% and US Michigan consumer sentiment higher at 59.8

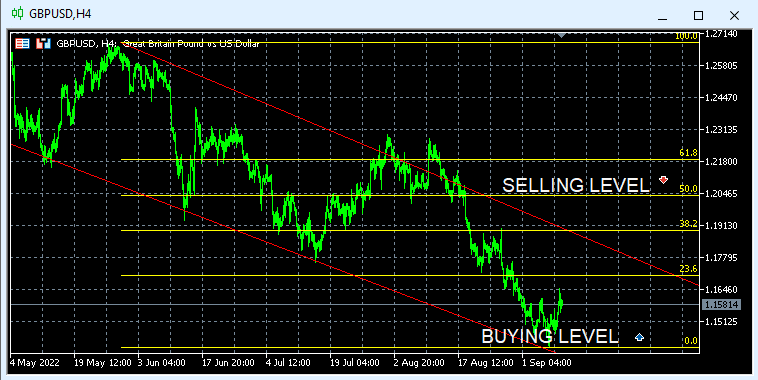

Technically the pair is negative after last week’s close below 23.6% In this week’s trading session if pair manages to maintained last week’s upside momentum , we are expecting to test 1.1913 Alternatively if pair resumes downside will retest 1.1400 A break below 0% could accelerate losses down to 1.1300 Our traders are net long 100% with positions opened between 1.2200 to 1.1500 targeting profits above 1.2200 We are expecting more aggressive buyers on the way down and short sellers to appear around 1.2200

Pour un calendrier économique plus détaillé, veuillez consulter notre calendrier économique en direct sur :

https://tentrade.com/economic-calendar/

*Le matériel ne contient pas d'offre ou de sollicitation pour une transaction sur des instruments financiers. TEN.TRADE décline toute responsabilité quant à l'utilisation qui pourrait être faite de ces commentaires et aux conséquences qui pourraient en résulter. Pas de représentation Aucune garantie n'est donnée quant à l'exactitude ou à l'exhaustivité de ces informations. Par conséquent, toute personne agissant sur la base de ces informations le fait entièrement à ses risques et périls. à leurs propres risques. Les CFD sont des produits à effet de levier. La négociation de CFD peut ne pas convenir à tout le monde et peut entraîner la perte de la totalité du capital investi ; assurez-vous donc de bien comprendre les risques encourus.