Week ahead September 5th – 9th

FUNDAMENTOS Y ASPECTOS TÉCNICOS DEL EUR/USD

Pair closed last week’s trading session lower on deepening European energy crisis. While the G7 gathered together to discuss a cap on Russian oil price, Russia has already permanently closed the supply of gas via its Nord stream pipe. Its more obvious now that any sanctions on Russia are weighing negative on European economy and the signs of a recession becoming stronger. The gas crisis weighted negative on the pair after its attempt to normalize on Jackson Hole symposium comments, where ECB officials agreed that the central bank should take more aggressive rate hike decisions. From the US Dollar side the better than expected non-farm payroll number show that the US economy is still far from any recession. Although the non-farm payroll did not generate huge volatility as the FED’ s dashboard is mainly focus on the inflation.

En cuanto a esta semana, todas las miradas estarán puestas en la decisión del BCE sobre la subida de tipos y en su rueda de prensa. Los operadores esperan una subida de tipos de 0,5% en esta reunión. Si el BCE realmente quiere estabilizar la caída libre de su moneda, la subida de tipos debería situarse en 0,75%. Si esto sucede, el par tiene cada vez más posibilidades de recuperarse y sigue cotizando por encima de la paridad. Si no se produce una subida de tipos satisfactoria, el par sufrirá presiones bajistas adicionales. Por otro lado, la crisis energética en Europa se convertirá en un quebradero de cabeza para los líderes de la UE, que tendrán que buscar soluciones diplomáticas en lugar de imponer sanciones a un producto que no pueden producir y sin el que no pueden vivir.

En el calendario económico tenemos el lunes, las ventas minoristas europeas apuntan a -0,7% El martes, el ISM de servicios estadounidense baja a 54,9 El miércoles, el PIB europeo se mantendrá sin cambios en 3,9% El jueves, el BCE subirá los tipos en 0,5%

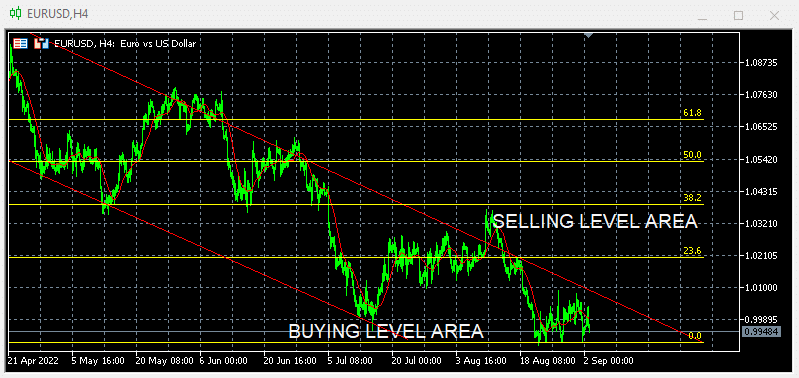

Technically the picture is negative after last week’s closed just above 0% The pair is still trading within a downtrend channel formation. In this week’s trading session if pair fails to resume upside move and turns down, and breaks below 0% will accelerate losses down to 0.9900 and beyond. If pair manage to recover and close above (23.6%) could change the picture back to neutral and test next level of 1.0370 (38.2%). Our traders are net 100% long with positions opened between 1.1350 to 1.0000 targeting profits above 1.1350 we are expecting more aggressive long positions on the way down. Alternative if pair continues trading on the upside, we are expecting short sellers to appear around 1.0370 (38.2%)

FUNDAMENTOS Y ASPECTOS TÉCNICOS DEL GBP/USD

Pair closed last week’s trading session lower on continuing US Dollar’s strength. The better than expected non-farm payroll and economic releases from the US weighted negative on the pair. The continuing energy crisis in the EU id directly affecting the UK that already faces very high inflation and high risks of recession.

As for this week the light economic calendar in the UK will let the pair once again in the mercy of it counter party US Dollar. A speech from BOE’s policymaker Catherine Mann will be closely monitored for any signs of a more aggressive policy from the central bank.

En el calendario económico tenemos el martes, BRC Like-for-Like retail sales to remain unchanged at 1.6% El martes, US ISM services lower at 54.9 El miércoles, BOE publicará su informe de política monetaria.

Technically the pair is negative after last week’s close on new multi year lows. the pair continues to trade within a downside channel formation. In this week’s trading session if pair manages to resume on the upside, we are expecting to retest 1.1700 Alternatively if pair continues on the downside will bring the pair into new lows of 1.1400 Our traders are net long 100% with positions opened between 1.2250 to 1.1600 targeting profits above 1.2250 We are expecting more aggressive buyers on the way down and short sellers to appear around 1.1950

Para conocer con más detalle los acontecimientos del calendario económico, visite nuestro calendario económico en directo en:

https://tentrade.com/economic-calendar/

*El material no contiene ninguna oferta ni solicitud de transacción de ningún instrumento financiero. TEN.TRADE no se hace responsable del uso que pueda hacerse de estos comentarios ni de las consecuencias que de ello se deriven. Sin representación no se ofrece garantía alguna en cuanto a la exactitud o integridad de esta información. Por consiguiente, toda persona que actúe sobre la base de la misma lo hace por su propia cuenta y riesgo. su propio riesgo. Los CFD son productos apalancados. Las operaciones con CFD pueden no ser adecuadas para todo el mundo y pueden dar lugar a la pérdida de todo el capital invertido.