未来一周 9月26日-30日

欧元/美元的基本面和技术面

Pair closed last week’s trading session lower registering a multi decade new low. The pair suffered huge selling pressure on FED’s rate hike of 0.75% that was accompanied by better than expected US economic releases. On the other side the Euro is getting into trouble as the energy crisis deepens and Russia adding nuclear threads against the EU. It looks like the Euro is entering into an oversold territory without end. The economic releases are so badly deteriorated that signals of recession are becoming stronger and stronger every week.

As for this week market participants will mainly focus on many speeches during the week from both ECB’s Christine Laggard and FED’s Jerome Powell. Both banks are in the same fight against inflation. Although the ECB is facing a strong front wind, the recession, and this is keeping the central bank more careful on its rate hike decisions. On the other side the FED can do more rate hikes of 0.25% each without affecting negative the US economy. Geopolitical turmoil will be the major element that will create more downside pressure on Euro as Russia is poised to annex three Ukraine states this week. That means, if Ukraine will try to attack a Russian territory, Russia could use nuclear weapons on Ukraine and situation will get out of control in Europe.

在经济日历上,我们有周一,德国IFO商业景气指数降低在87.1,周二,美国耐用品订单预期降低在-1.1%,周四,德国消费者价格协调指数预期提高在9.8%,美国国内生产总值保持不变在-0.6%,周五,德国零售销售预期降低在-5.1%,欧洲HICP保持不变在9.1%,美国密歇根消费者情绪不变在59.5。

Technically the picture is negative after last week’s closed below 23.6% In this week’s trading session if pair fails to resume upside move and continues on the downside , will accelerate losses down to 0.9550. If pair manage to recover and close above (23.6%) could change the picture back to neutral and test next level of 1.0118 (38.2%). Our traders have stopped out all long positions after the pair broke below 0.9880 and now they are sitting on the side and waiting for new levels to enter. We are expecting new buyers around 0.9500 alternative if pair resumes upside we are expecting short sellers to appear at 1.0118

英镑/美元的基本面和技术面

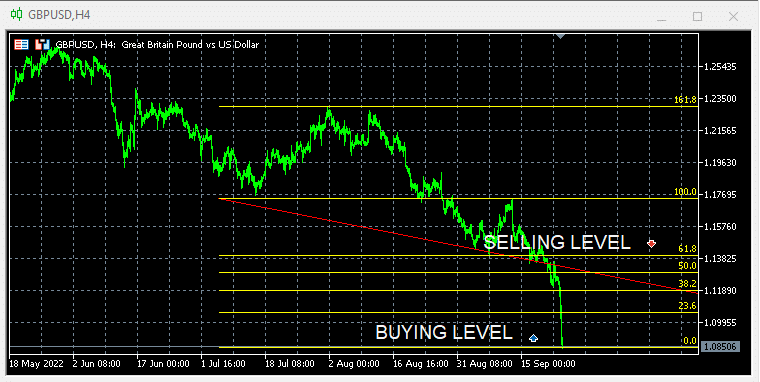

Pair closed last week’s trading session on extremely lower level never seen before. The FED hike rates by 0.75% and in combination with the better than expected economic releases from the US added more downside pressure to the pair. On the other side the BOE failed to deliver what market was expected. The 0.5% rate hike with the negative comments of BOE’s governor, confirming that the UK economy is officially in recession, was more than enough to accelerate losses.

As for this week market participants will focus on both central bank’s speeches. Traders should follow carefully what the central banks have to say and gather more information on the UK recession and how the central banks are planning to fight inflation while in the same time should avoid worsening their economic outlook.

在经济日历上,我们将在周二看到美国耐用品订单,预期为-1.1%,周四,美国国内生产总值将保持不变,为-0.6%,周五,英国国内生产总值将保持不变,为-0.1,美国密歇根消费者情绪保持不变,为59.5。

Technically the pair is negative after last week’s new multi years lower registration. In this week’s trading session if pair manages to recover lost ground and close above 1.1050 (23.6%) we are expecting to test 1.1820 (38.2%) Alternatively a break below 0% could accelerate losses down to 1.0700 Our traders have stop out all their long positions after broke below 1.1300 and now are sitting on the side waiting for new levels. We are expecting new buyers at 1.0800 and short sellers at 1.1800

更详细的经济日历事件,请访问我们的实时经济日历。

https://tentrade.com/economic-calendar/

*该材料不包含任何金融工具的交易要约或征求意见。TEN.TRADE对可能使用这些评论和由此产生的任何后果不承担任何责任。 没有代表 对这些信息的准确性或完整性不做任何保证。因此,任何根据这些信息行事的人完全是在 自己的风险.差价合约是杠杆产品。差价合约交易可能不适合每个人,并可能导致你失去所有的投资资本,所以请确保你完全了解其中的风险。