Week ahead October 3rd – 7th

欧元/美元的基本面和技术面

Pair closed last week’s trading session firm higher on hawkish comments from ECB’s officials, highlighting once again that the central bank will continue its aggressive quantitative tightening program until inflation will come back to normal level around 2.5%. The comments were very well applause by markets and pair retreated sharp higher. Although the upside rally didn’t last long as the deteriorated economic outlook from the EU and the better than expected economic outlook from the US weighted negative on pair.

As for this week market participants will mainly focus on the speeches from many FED officials and the non-farm payroll number. From the EU side the discussions around price cap on gas and the control of energy crisis, continues without any common ground. EU is facing an unprecedented problem to be solve and this will test the ability of the block to be united on such crisis. The worst the energy crisis is becoming, the more divide the block’s members and this will weight negative on Euro.

On the economic calendar, we have on Monday, US ISM manufacturing PMI pointing lower at 52.3 On Wednesday, US ADP employment expected to add 200K new jobs and US ISM Services PMI expected lower at 56 On Thursday, EU retail sales expected lower at -1.7% On Friday, German retail sales expected lower at -5.1% and US non-farm payrolls to add 250K new jobs

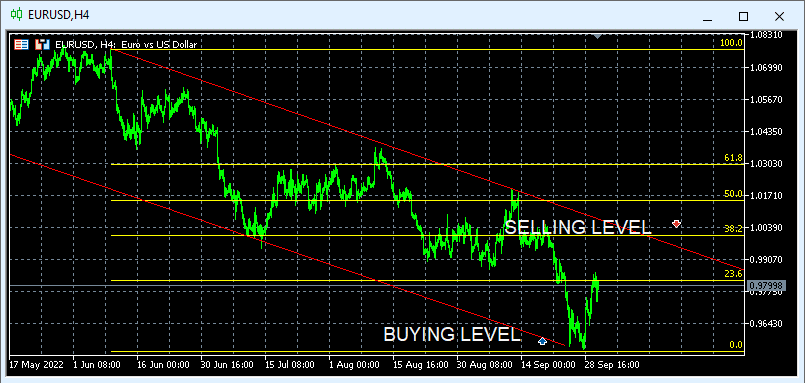

Technically the picture is negative after last week’s close below 23.6% In this week’s trading session if pair continues on the upside and close above (23.6%) could change the picture back to neutral and test next level of 1.0030 (38.2%). Alternatively, if pair resumes downside we are expecting to retest last week’s low of 0.9550 (0%) We are expecting new buyers at 0.9550 targeting profits at 1.0000 and short sellers at 1.0030 targeting profits at 0.9550

英镑/美元的基本面和技术面

Pair closed last week’s trading session higher after a flash crash on early opening hours on Monday. The pair has registered an all time low of 1,0300 during early hours on Monday and then with the help of an intervention of the BOE, recovered and closed higher. Prime minster Liz Truss comments that she will work side by side with the central bank and stabilize market conditions and Pounds depreciation. The central bank on their comments reiterated PM’s comments and agree on a more aggressive tightening policy until they bring inflation down to normal levels. The announce of BOE to purchase UK government bonds it was the signal that pound needed to trigger the rally.

As for this week market participants will focus on the US non-farm payroll numbers and a speech from BOE’s Ramsden. The light economic releases in the UK will keep the pound on the mercy of its counter party US Dollar. The speeches from FED’s officials should also be followed in order to gather more information for the next move of the central bank.

On the economic calendar we have on Monday, UK Manufacturing PMI to remain unchanged at 48.5 US ISM manufacturing PMI pointing lower at 52.3 On Wednesday, UK composite PMI expected at 48.4 US ADP employment expected to add 200K new jobs and US ISM Services PMI expected lower at 56 On Friday, US non-farm payrolls to add 250K new jobs

Technically the pair is neutral after the huge recovery that followed after the technical flash crash that registered a new ever low with US Dollar. In this week’s trading session if pair manages to close above 1.1273 (61.8%) will change the picture from neutral to positive and could open the road to full recovery up to 1.1800 Alternatively a break below 50% could accelerate losses down to 1.0900 We are expecting new buyers at 1.0700 and short sellers at 1.1800

更详细的经济日历事件,请访问我们的实时经济日历。

http://tentrade.com/economic-calendar/

*该材料不包含任何金融工具的交易要约或征求意见。TEN.TRADE对可能使用这些评论和由此产生的任何后果不承担任何责任。 没有代表 对这些信息的准确性或完整性不做任何保证。因此,任何根据这些信息行事的人完全是在 自己的风险.差价合约是杠杆产品。差价合约交易可能不适合每个人,并可能导致你失去所有的投资资本,所以请确保你完全了解其中的风险。

很抱歉,必須登入網站才能發佈留言。