Week Ahead March 11 – 15

EURUSD pair closed last week’s trading session higher on disappointing US hourly earnings and on hawkish ECB meeting. ECB maintained interest rates unchanged as it was widely expected, but, reiterated that reducing interest rates will need stronger evidence that inflation is near to ECBs target. The US non-farm payroll came out better than expectations, although the negative hourly earnings over shadowed the non-farm payroll and triggered a selloff in US dollar.

As for this week, traders and investors will mainly focus on the US CPI due to be released on Tuesday. The US CPI is the main catalyst for any future interest rates decision from FED. From the Euro side there are no economic events so the pair will be on the mercy of US Dollar.

On the economic calendar we have on Tuesday, the German Harmonized index of consumer prices to remain unchanged at 2.7% and US consumer price index unchanged at 3.1% On Thursday, US producer price index to remain unchanged at 2% and retail sales higher at 0.7% On Friday, US Michigan consumer sentiment expected lower at 76.6

Technically the picture remains neutral after last week’s close below (61.8%) at 1.0940 In this week’s trading session if pair trades on the downside will test 1.0862 If trades on the upside and breaks and closes above (61.8%) will open the road for 1.1100 Our traders took profit their long positions at 1.0960 We are expecting new long positions at 1.0860 and new short positions at 1.1100

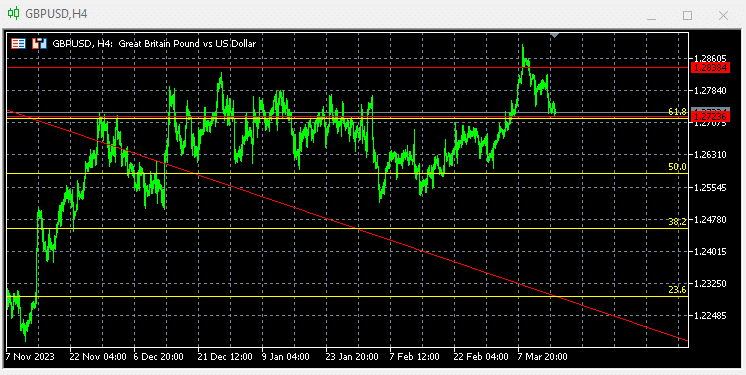

GBPUSD pair closed last week’s trading session higher on disappointing US hourly earnings The US non-farm payroll came out better than expectations, although the negative hourly earnings over shadowed the non-farm payroll and triggered a selloff in US dollar.

As for this week, traders and investors will mainly focus on the US CPI due to be released on Tuesday. The US CPI is the main catalyst for any future interest rates decision from FED. From the GBP side there are some economic events with not any major impact so the pair will be on the mercy of US Dollar.

On the economic calendar we have on Tuesday, the UK ILO unemployment rate steady at 3.8%and US consumer price index unchanged at 3.1% On Wednesday, UK gross domestic product pointing higher at 0.2% manufacturing production lower at -1% On Thursday, US producer price index to remain unchanged at 2% and retail sales higher at 0.7% On Friday, US Michigan consumer sentiment expected lower at 76.6

Technically the pair’s overall picture is positive after last week’s close above (61.8%) at 1.2857 As for this week, if pair trades on the upside, will test 1.3100 Alternative, if trades on the downside, will retest 1.2720 Our traders stay with short positions at 1.2723 and 1.2850 targeting profits at 1.2500. We are expecting more aggressive short sellers above 1.2900 targeting profits at 1.2500 and long positions at 1.2460

更详细的经济日历事件,请访问我们的实时经济日历。

https://tentrade.com/economic-calendar/

*本资料不包含任何金融工具的交易要约或招揽。TenTrade对任何使用这些评论的行为以及由此产生的任何后果不承担任何责任。 没有代表 对这些信息的准确性或完整性不做任何保证。因此,任何根据这些信息行事的人完全是在 自己的风险.差价合约是杠杆产品。差价合约交易可能不适合每个人,并可能导致你失去所有的投资资本,所以请确保你完全了解其中的风险。