GBP/USD Outlook: Market Awaits BOE Speeches Amid Policy Speculation

The EURUSD pair closed last week’s trading session marginally higher on the Fed’s rate cut. As it was widely expected, the Fed cut interest rates by 0.25% and signaled a cautious approach to further rate cuts, as inflation is still elevated. On the Euro side, ECB President Lagarde highlighted, once again, that there will be no rate reductions or policy changes for now.

Looking ahead to this week, traders and investors will mainly focus on the economic calendar and key technical levels. No major high-impact events are scheduled, apart from speeches from Fed and ECB officials.

Economic Calendar Outlook – PMI, GDP & PCE

The events on the economic calendar to keep an eye on this week are as follows:

Tuesday: European Manufacturing PMI is expected at 50, while U.S. Manufacturing PMI is forecast to remain unchanged at 53.

Thursday: U.S. GDP is expected to remain steady at 3.3%.

Friday: U.S. Personal Consumption Expenditures (PCE) are projected lower at 0.2%.

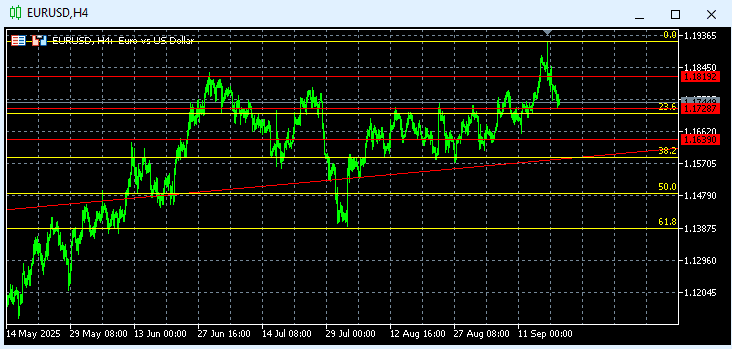

Technical Outlook – EURUSD

The picture remains positive after last week’s close above the 23.6% retracement at 1.1744. In this week’s session:

On the upside, a move higher could test 1.1950. A breakout and close above 1.1950 would pave the way toward 1.2050.

On the downside, support lies at 1.1713 (23.6%). A break and close below 1.1713 would add downside pressure, with the next target at 1.1580.

Traders currently hold short positions between 1.1640 and 1.1819, targeting profits at 1.1400. We also expect more aggressive short positioning on the way up, with new long entries considered around 1.1590.

EURUSD chart, September 20, 2025. Source: TenTrade.com

BOE Monetary Policy Brought GBPUSD Down

The GBPUSD pair closed last week’s trading session lower following the BOE’s monetary policy decision. As widely expected, the BOE kept interest rates unchanged, although comments on future policy suggested a possible rate cute before the end of the year. Softer inflation data and the BOE’s remarks weighted negatively on the GBP, keeping the pair under pressure throughout the week.

The Week’s Focus – BOE Official Speeches

Looking ahead, traders and investors will mainly focus on the economic calendar and speeches from BOE officials.

Other main events to look out for:

Tuesday: UK Manufacturing PMI is expected to remain unchanged at 47, while U.S. Manufacturing PMI is forecast to hold steady at 53.

Thursday: U.S. GDP is expected to remain unchanged at 3.3%.

Friday: U.S. Personal Consumption Expenditures (PCE) are projected lower at 0.2%.

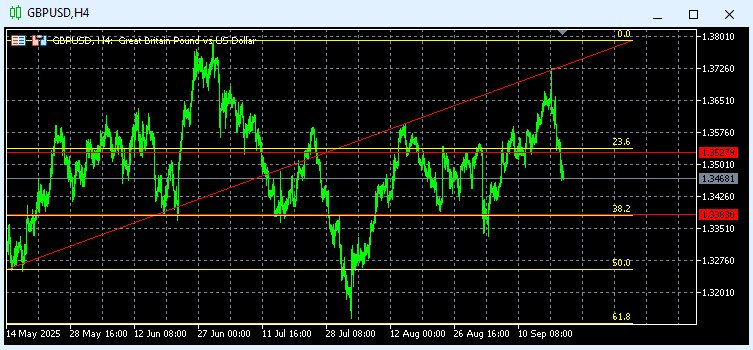

Technical Outlook – GBPUSD

The pair’s overall picture is neutral after last week’s close below the 23.6% retracement level at 1.3468. In this week’s session:

On the upside, a move higher would test 1.3540. A breakout and close above this level could open the road toward 1.3800.

On the downside, support lies at 1.3372 (38.2%). A break and close below this level would expose the next support at 1.3255.

Traders currently hold short positions at 1.3383 and 1.3527, targeting profits at 1.3200. We also expect more aggressive short positioning on the way up, with new long positions considered around 1.3243.

GBPUSD chart, September 20, 2025. Source: TenTrade.com

Pour un calendrier économique plus détaillé, veuillez consulter notre calendrier économique en direct sur :

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. Pas de représentation Aucune garantie n'est donnée quant à l'exactitude ou à l'exhaustivité de ces informations. Par conséquent, toute personne agissant sur la base de ces informations le fait entièrement à ses risques et périls. à leurs propres risques. Les CFD sont des produits à effet de levier. La négociation de CFD peut ne pas convenir à tout le monde et peut entraîner la perte de la totalité du capital investi ; assurez-vous donc de bien comprendre les risques encourus.