Week ahead July 25th – 29th

EUR/USD FUNDAMENTALS AND TECHNICAL

Pair closed last week’s trading session higher on ECB’s rate hike decision. The central bank increase rates by 0.5% on Thursday’s meeting in an effort to stabilize inflation and normalizing their monetary policy. The rate hike was well welcomed by markets, although the rally did not last long. Comments from ECB’s president Lagarde over economy’s slow down was taken negative by markets. Deteriorated economic releases during last week’s trading session, was another factor behind Euro’s pullback. The worst than expected economic releases reinforced ECB’s warnings of an economic slow down in the EU.

As for this week, market participants will mainly focus on the FOMC minutes, due to be released on Wednesday. The FED is expected to hike rates by 0.75%. Investors and traders will be cautious on this meeting as the FED might continue its aggressive policy and signal higher rates ahead of the end of the year. If FED will fail to deliver what markets are expecting, we could see the pair resuming last week’s rally. The heavy economic calendar in the US will be the major market mover in this week’s session.

On the economic calendar, we have on Monday, German IFO business climate pointing lower at 90.5 On Wednesday, US Durable goods orders expected lower at -0.2% and later the FED expected to hike rates by 0.75%. On Thursday, German Harmonized index of consumer prices expected lower at 8.1% and US Gross domestic product higher at 0.9%. On Friday, German gross domestic product pointing lower at 0.1%, European gross domestic product lower at 3.4% and European HICP higher at 8.7%

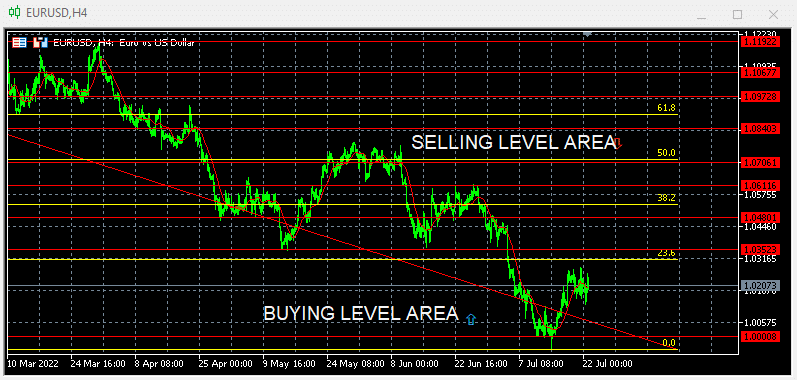

Technically the picture is negative after last week’s closed below 23.6% In this week’s trading session if pair fails to resume upside move and turns down, will retest 1.0000, if breaks below 1.0000 will accelerate losses down to 0.9900. If pair manage to recover and close above (23.6%) could change the picture back to neutral and test next level of 1.0530 (38.2%). Our traders are net 100% long with positions opened between 1.1350 to 1.0000 targeting profits above 1.1350 we are expecting more aggressive long positions on the way down. Alternative if pair continues trading on the upside, we are expecting short sellers to appear around 1.0530 (38.2%)

GBP/USD FUNDAMENTALS AND TECHNICAL

Pair closed last week’s trading session higher on US Dollar’s weakness due to worst than expected economic releases. The pair manage to recover some lost ground during last week’s session on the lack of any high impact economic releases from the US and on UK’s PMI that surprised markets after registering a higher than expected number of 52.8.

As for this week market participants will focus on the US FOMC minutes due to be released on Wednesday. The FED is expected to hike rates by 0.75% on this meeting. If the central bank will deliver this and maintain its aggressive monetary policy the pair may face additional downside pressure. If FED will failed to deliver what markets are expecting we may see the rally to be resumed and help the pair recovering more lost ground. The lack of any economic releases in the UK will keep the pair in the mercy of US Dollar.

On the economic calendar we have on Wednesday, US Durable goods orders with expectation to be lower at -0.2% and later the FED expected to hike rates by 0.75% On Thursday, US Gross domestic product expected higher at 0.9%

Technically the pair is negative after last week’s close below 23.6% In this week’s trading session if pair manages to resume upside move, we are expecting to test 1.2210 (23.6%) Alternatively if pair continues on the downside, will retest 1.1800 A break below 0% could accelerate losses down to 1.1700 Our traders are net long 100% with positions opened between 1.3412 to 1.1950 targeting profits above 1.3400 We are expecting more aggressive buyers on the way down and short sellers to appear around 1.2625

For more detailed economic calendar events please visit our live economic calendar on:

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TEN.TRADE accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. CFDs are leveraged products. CFD trading may not be suitable for everyone and can result in losing all your invested capital, so please make sure that you fully understand the risks involved.