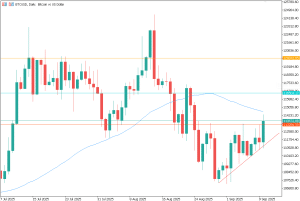

Bitcoin (BTC/USD) – Resistance Breakout at 113,300

Bitcoin has successfully broken through the 113,300 resistance level, which had been tested three times over the past two weeks. During that period, price retraced as low as 107,000 Dollars, putting the key support zone around 110,000 Dollars to the test.

The breakout above 113,300 Dollars occurred during the U.S. session opening, a time of high trading volume, which strengthens the validity of this move and suggests a clear buying opportunity.

BTUSD chart, September 11, 2025. Source: TenTrade.com

Bullish Scenario (Buy Setup)

This bullish scenario could be used in trading strategies with the following buy setup:

- Entry Zone: Between 113,500 and 113,800

- Take Profit 1: 116,500

- Take Profit 2: 120,000

- Stop Loss: Around 111,500, aligned with the support of the ascending trendline shown in the chart

BTUSD chart, September 11, 2025. Source: TenTrade.com

Trade Management

Once the first take profit target (116,500) is reached, traders may move the stop loss to breakeven (entry level) to secure the trade and eliminate downside risk.

Strategy Notes: An Attractive Risk-to-Reward Ratio

This setup offers an attractive risk-to-reward ratio, particularly suitable for a short- to medium-term trade horizon. The confirmation of the breakout during a high-volume session increases the probability of continued upside toward the outlined targets.

Key Takeaways

- Resistance Cracked – Bitcoin broke the key $113,300 resistance after multiple failed attempts.

- Volume-Backed Breakout – The move happened during high U.S. session volume, adding strength to the signal.

- Buy Zone Identified – Ideal entry range set between $113,500–$113,800 for bullish traders.

- Targets in Sight – Profit levels aim for $116,500 and $120,000, with a stop loss at $111,500.

- Smart Risk Management – Trade offers solid risk-reward; move stop to breakeven after first target hits.

The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. CFDs are leveraged products. CFD trading may not be suitable for everyone and can result in losing all your invested capital, so please make sure that you fully understand the risks involved.