September 1st – 5th

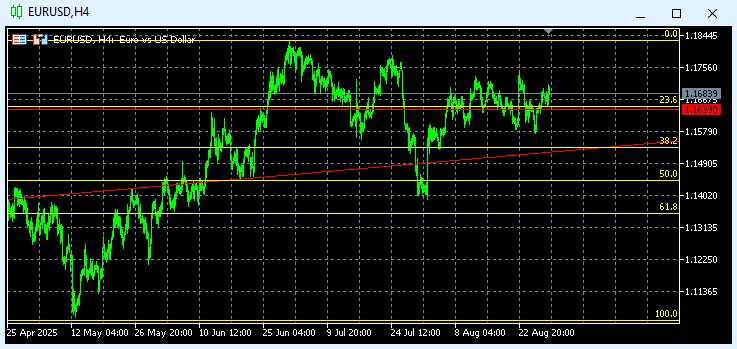

EURUSD pair closed last week’s trading session marginally lower on Jackson hole economic forum. As the central bank’s official’s’ speeches went through the news and there was not any change in central banks’ policies the pair continue it trading session through the week within tide range. The better than expected US economic indicators are adding pressure on FED with expectation now that on the next meeting the interest rate cut of 0.25% is inevitable.

As for this week, traders and investors will mainly focus on the US nonfarm payroll due to be released on Friday. This week’s trading session will be dominated by the speeches from ECB’s officials.

On the economic calendar we have on Tuesday, the European core harmonized index of consumer prices with expectation to be lower at 2.2% later US ISM manufacturing PMI expected higher at 48.6 On Thursday, European retail sales pointing lower at -0.2% US ADP employment to add 72K new jobs and US ISM services PMI expected higher at 50.5 On Friday, European gross domestic product to remain unchanged at 1.4% US Nonfarm payrolls to add 78K new jobs and US hourly earnings unchanged at 0.3%

Technically the picture is positive after last week’s close above (23.6%) at 1.1683 In this week’s trading session if pair trades on the upside will test 1.1850 A break out and close above 1,1850 will open the road for 1.1950 If trades on the downside will test 1.1650 (23.6%) A break and close below 1.1650 will add downside pressure and test 1.1530 Our traders are standing with short positions at 1.1640 targeting profits at 1.1400 we are expecting more aggressive short positions on the way up and new long positions at 1.1348

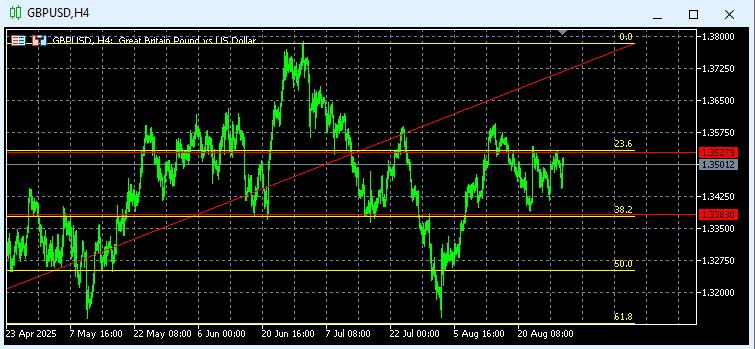

GBPUSD pair closed last week’s trading session marginally lower on Jackson hole economic forum. As the central bank’s official’s’ speeches went through the news and there was not any change in central banks’ policies the pair continue it trading session through the week within tide range. The better than expected US economic indicators are adding pressure on FED with expectation now that on the next meeting the interest rate cut of 0.25% is inevitable.

As for this week, traders and investors will mainly focus on the US nonfarm payroll due to be released on Friday.

On the economic calendar we have on Tuesday, the US ISM manufacturing PMI with expectations to be higher at 48.6 On Thursday, US ADP employment to add 72K new jobs and US ISM services PMI expected higher at 50.5 On Friday, UK Retail sales expected lower at 0.2% US Nonfarm payrolls to add 78K new jobs and US hourly earnings unchanged at 0.3%

Technically the pair’s overall picture is neutral after last week’s close below (23.6%) at 1.3500 As for this week, if pair trades on the upside, will test 1.3530 A break and close above 1.3530 will open the road for 1.3800 Alternative, if trades on the downside, will test 1.3372 (38.2%) A break and close below 1.3372 will open the road for 1.3255 Our traders are standing with short positions at 1.3383 and 1.3527 targeting profits at 1.3200 we are expecting more aggressive short positions on the way up and new long positions at 1.3243

Para eventos mais detalhados do calendário econômico, por favor, visite nosso calendário econômico ao vivo em:

https://tentrade.com/economic-calendar/

*O material não contém uma oferta ou solicitação de uma transação em nenhum instrumento financeiro. A TenTrade não se responsabiliza por qualquer uso que possa ser feito desses comentários e por quaisquer conseqüências que deles possam resultar. Sem representação ou a garantia é dada quanto à precisão ou completude destas informações. Conseqüentemente, qualquer pessoa agindo sobre ela o faz inteiramente em seu próprio risco. Os CFDs são produtos alavancados. A negociação de CFDs pode não ser adequada para todos e pode resultar na perda de todo o seu capital investido, portanto, por favor, certifique-se de compreender plenamente os riscos envolvidos.