Week Ahead May 6th – 10th

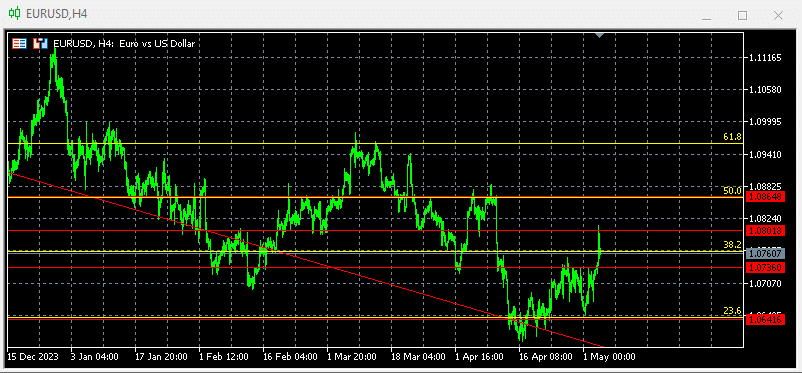

EURUSD pair closed last week’s trading session higher on European higher CPI print, as this could add pressure on ECB to keep interest rates higher for longer. On the hand the disappointing economic releases in the US weighted negative on US Dollar and that kept the pair higher. Disappointing non-farm payroll and average hourly earnings were the biggest catalysts behind last week’s US dollar selloff. FED maintained interest rates unchanged and highlighted that is not yet appropriate to reduce interest rates until is confidence that they achieved their inflation target.

As for this week, traders and investors will mainly focus on a few FED’s officials’’ speeches. The lack on any high impact economic releases will keep the pair trading on technical levels.

On the economic calendar we have on Tuesday, the European retail sales pointing at -0.7% and on Friday the US Michigan consumer sentiment pointing lower at 77

Technically the picture is negative after last week’s close just below (38.2%) at 1.0760 In this week’s trading session if pair trades on the downside will test 1.0640 If trades on the upside will retest 1.0864 Our traders standing firm with long positions between 1.0863 and 1.0640 targeting profits at 1.0900 We are expecting more aggressive long positions on the way down and new short positions above 1.0900

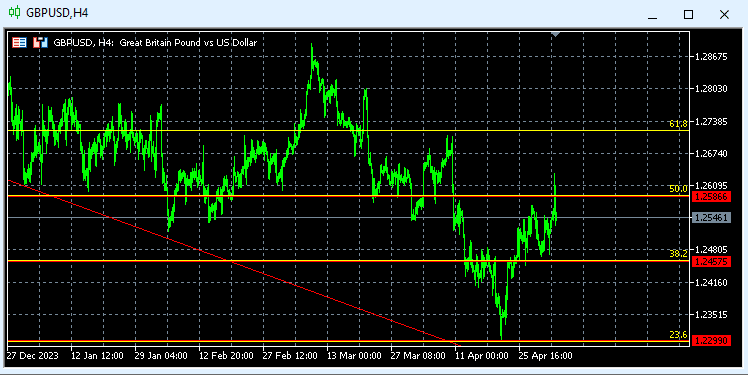

GBPUSD pair closed last week’s trading session higher on disappointing economic releases in the US that weighted negative on US Dollar and that kept the pair higher. Disappointing non-farm payroll and average hourly earnings were the biggest catalysts behind last week’s US dollar selloff. FED maintained interest rates unchanged and highlighted that is not yet appropriate to reduce interest rates until is confidence that they achieved their inflation target.

As for this week, traders and investors will mainly focus on Thursday’s BOE’s interest rates decision and press conference. The central bank is not expected to cut rates at this meeting, although the press conference and minutes to be release will guide investors and traders what will be the future path for the central bank. Form, the US side the speeches from few FED’s officials could send some thought in the market regarding future path of FED’s on interest rates.

On the economic calendar we have on Tuesday, the UK BRC Like-for-Like retail sales pointing at 3.2% ON Thursday, BOE interest rate decision, monetary policy report and press conference. On Friday, UK Gross domestic product expected higher at 0.4% and US Michigan consumer sentiment expected lower at 77

Technically the pair’s overall picture is neutral after last week’s close below (50%) at 1.2546 As for this week, if pair trades on the upside, will test 1.2600 Alternative, if trades on the downside, will test 1.2457 (38.2%) Our traders are long between 1.2566 and 1.2300 targeting profits above 1.2800 We are expecting more aggressive long positions on the way down and new short sellers above 1.2700 targeting profits at 1.2600

Per un calendario economico più dettagliato, visitate il nostro calendario economico in tempo reale su:

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. Nessuna rappresentanza non viene fornita alcuna garanzia circa l'accuratezza o la completezza di queste informazioni. Di conseguenza, chiunque agisca in base ad esse lo fa a totale rischio e pericolo. il proprio rischio. I CFD sono prodotti con leva finanziaria. Il trading con i CFD può non essere adatto a tutti e può comportare la perdita dell'intero capitale investito, pertanto è bene accertarsi di aver compreso appieno i rischi connessi.