Week Ahead June 3rd – 7th

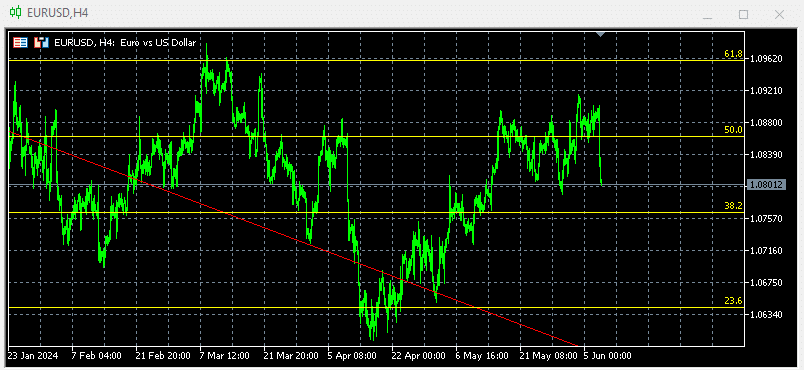

EURUSD pair closed last week’s trading session unchanged. Pair has traded in a tide range during the week as investors and traders weighted the US PCE and European CPI numbers. Both numbers came on line with expectations and this was the reason why we had an up and down weekly trading session that finally resulted in closing around same levels. Both high impact releases will keep both central banks on hold regarding their interest rate policy.

As for this week, traders and investors will mainly focus on the ECB rate decision and press conference. The central bank is expected to cut interest rates by 0.25%. If the bank will move into cutting rates, Euro will come under pressure and the pair will trade lower. Alternative, if the central bank will not cut interest rates and use a hawkish language during the press conference this might push the pair higher. The US non-farm payroll is due to be release on Friday. 180K new jobs are expected to be added on the nonfarm payroll for May 2024. With the average hourly earnings steady at 3.9%

On the economic calendar we have on Monday the US ISM manufacturing PMI pointing higher at 49.8 On Wednesday, US ADP employment expected to show another 180K new jobs and US ISM services PMI expected higher at 50.5 On Thursday, European retail sales expected at 0.7% On Friday, European gross domestic product to remain unchanged at 0.3% US Non-farm payroll to add 180K new jobs and US Average hourly earnings to remain unchanged at 3.9%

Technically the picture is neutral after last week’s close below (50%) at 1.0848 In this week’s trading session if pair trades on the upside will test 1.0950 If trades on the downside will test 1.0772 Our traders are sitting with sell positions opened at 1.0865 targeting profits below 1.0700 We are expecting more aggressive short positions on the way up and new long positions on the way down.

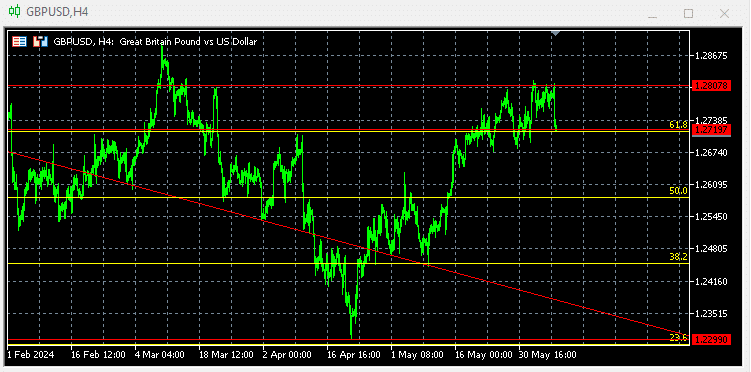

GBPUSD pair closed last week’s trading session unchanged. Pair has traded in a tide range during the week as investors and traders weighted the US PCE. PCE came on line with expectations and this was the reason why we had a tide range in weekly trading session that finally resulted in closing unchanged. The high impact release will keep FED on hold regarding the interest rate policy.

As for this week, traders and investors will mainly focus on the US non-farm payroll that is due to be release on Friday. 180K new jobs are expected to be added on the nonfarm payroll for May 2024. With the average hourly earnings steady at 3.9% The lack of any economic release in the UK will let the pair in the mercy of it counterparty US Dollar.

On the economic calendar we have on Monday the US ISM manufacturing PMI pointing higher at 49.8 On Wednesday, US ADP employment expected to show another 180K new jobs and US ISM services PMI expected higher at 50.5 On Friday, US Non-farm payroll to add 180K new jobs and US Average hourly earnings to remain unchanged at 3.9%

Technically the pair’s overall picture is positive after last week’s close above (61.8%) at 1.2741 As for this week, if pair trades on the upside, will test 1.2800 Alternative, if trades on the downside, will test 1.2586 (50%) Our traders entered new short positions at 1.2720 targeting profits at 1.2600 we are expecting more aggressive short positions on the way up and ne long positions below 1.2600

Per un calendario economico più dettagliato, visitate il nostro calendario economico in tempo reale su:

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. Nessuna rappresentanza non viene fornita alcuna garanzia circa l'accuratezza o la completezza di queste informazioni. Di conseguenza, chiunque agisca in base ad esse lo fa a totale rischio e pericolo. il proprio rischio. I CFD sono prodotti con leva finanziaria. Il trading con i CFD può non essere adatto a tutti e può comportare la perdita dell'intero capitale investito, pertanto è bene accertarsi di aver compreso appieno i rischi connessi.