Week Ahead June 17th – 21st

EURUSD pair closed last week’s trading session lower on Political risk in Europe. European parliament results show a rise in far-right political parties, something that current leaders do not like. French President calls for snap election in France to avoid the possibility of French parliament control from the far-right party of Le Pen. In others the Dovish FOMC and softer US inflation did not manage to push the pair higher as the politics dominated European markets. FED signal 3 rate cuts in 2024 with more to come in 2025.

As for this week, traders and investors will mainly focus on the European inflation number due to be released on Tuesday. A softer that expected release will add downside pressure on pair. The lack of any speeches from FED’s and ECB’s officials will keep investors and traders counting mostly on technical levels.

On the economic calendar we have on Tuesday the European core Harmonized index of consumer prices to remain unchanged at 2.9% and US Retail sales pointing higher at 0.3% On Friday, European Manufacturing PMI expected higher at 48 and US Services PMI lower at 53.5

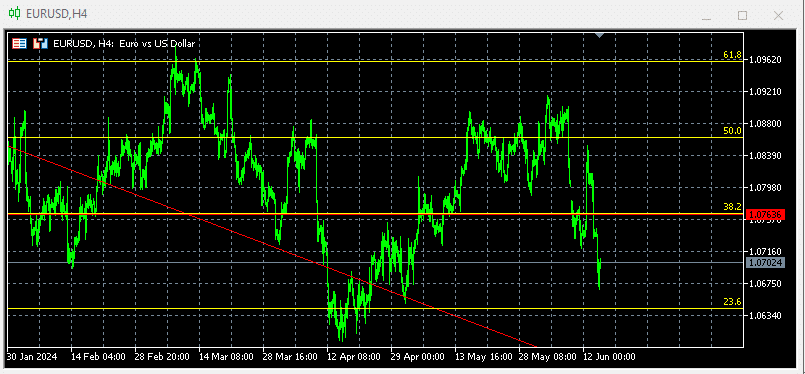

Technically the picture is negative after last week’s close below (38.2%) at 1.0701 In this week’s trading session if pair trades on the upside will test 1.0764 If trades on the downside will test 1.0604 Our traders entered new long positions at 1.0764 targeting profits at 1.0900 we are expecting more aggressive long positions on the way down and short position above 1.0865

GBPUSD pair closed last week’s trading session lower on deteriorating economic indicators in the UK. Dovish FOMC and softer US inflation push the pair initially higher, although later by the end of the week pair erased all gains most probable affected by European parliamentary elections. Another reason behind last week’s downside reversal could be the pre-position on GBP ahead of this week’s BOE meeting and interest rate decision.

As for this week, traders and investors will mainly focus on the BOE meeting and interest rate decision. Bank of England is not expected to cut rates at this meeting although they may follow the path of FED to signal interest rates reduction on the next meetings of 2024. UK inflation will be the biggest catalyst for this week’s trading session due to be released a day earlier form BOE rate decision, the number can add pressure on MPs to cut rates earlier than expected.

On the economic calendar we have on Tuesday the US Retail sales pointing higher at 0.3% On Wednesday, UK Consumer price index expected lower at 3.5% On Friday, UK Retail sales expected at -2.3% UK Services PMI pointing higher at 53.2 and US Services PMI lower at 53.5

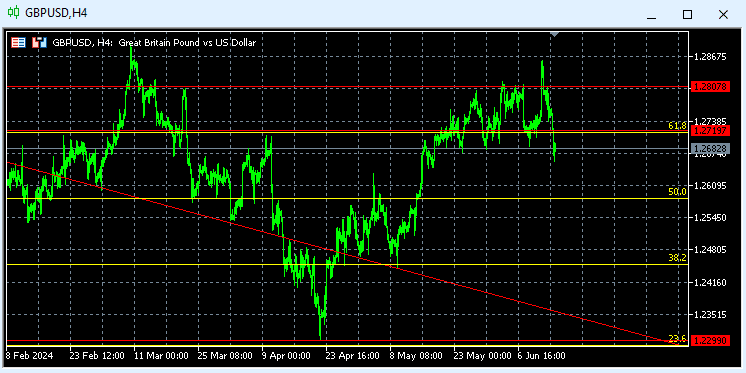

Technically the pair’s overall picture is neutral after last week’s close below (61.8%) at 1.2682 As for this week, if pair trades on the upside, will test 1.2870 Alternative, if trades on the downside, will test 1.2586 (50%) Our traders are standing with short positions at 1.2800 and 1.2720 targeting profits at 1.2600 we are expecting more aggressive short positions on the way up and new long positions below 1.2600

Per un calendario economico più dettagliato, visitate il nostro calendario economico in tempo reale su:

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. Nessuna rappresentanza non viene fornita alcuna garanzia circa l'accuratezza o la completezza di queste informazioni. Di conseguenza, chiunque agisca in base ad esse lo fa a totale rischio e pericolo. il proprio rischio. I CFD sono prodotti con leva finanziaria. Il trading con i CFD può non essere adatto a tutti e può comportare la perdita dell'intero capitale investito, pertanto è bene accertarsi di aver compreso appieno i rischi connessi.