S&P 500: The Uptrend Holds, With Strong Potential for New Highs

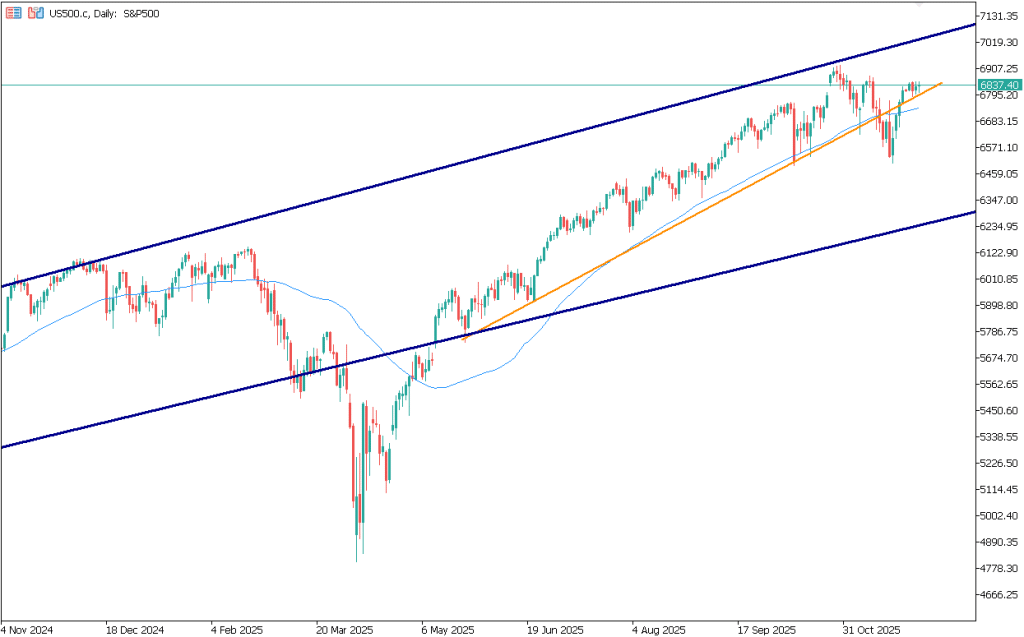

The S&P 500 has once again demonstrated its strength, recovering the key trendline support highlighted two weeks ago. This recovery confirms that the long-term uptrend remains intact, despite recent volatility and extreme fear readings in market sentiment indices.

Currently, the index is just 1% below its all-time highs, a level that reflects investors’ continued cautiousness, although the underlying technical structure remains favorable.

US500 chart, November 18, 2025. Source: TenTrade.com

Favorable Seasonal and Macroeconomic Factors

Historically, December has been seen as a positive month for U.S. markets, thanks to the so-called Santa Claus Rally, when indices tend to post sustained gains.

This is further supported by market expectations that the FOMC could cut rates at its next meeting, a scenario that directly favours the continuation of the uptrend.

Improvements in Liquidity and Risk Appetite

Liquidity indicators are showing positive signs:

- The VIX has returned to relatively calm levels.

- Spreads between junk bonds and high-quality bonds appear to be narrowing, indicating that risk appetite is returning.

Even liquidity-sensitive assets like Bitcoin are showing signs of a floor and a significant rebound this week after a challenging November. This behaviour provides positive information regarding liquidity availability in financial markets.

Positive Institutional Signals for Bitcoin and Risk Assets

Bitcoin’s evolution also reflects changes in institutional sentiment:

- Starting in January, the Bank of America will offer its clients the option to invest between 1% and 4% of their assets in Bitcoin.

- JPMorgan has launched a structured product linked to Bitcoin, interpreted as a positive outlook for its performance over the next two years.

- Vanguard, despite previously ruling out offering Bitcoin, has launched its Bitcoin ETF, expanding institutional access.

These decisions reinforce the perception of a recovery in risk appetite and relative stability in liquidity markets.

Our View and Most Likely Scenario

Considering:

- The recovery of the key trendline since May.

- Improving liquidity and volatility indicators.

- December’s favorable seasonal context.

- The possibility of an FOMC rate cut.

The most likely scenario is that the S&P 500 will reach new all-time highs before the end of the year.

Current prices, just above the trendline support, offer an attractive entry point for investors looking to position themselves toward year-end and take advantage of the bullish momentum.