Currency Pulse: Turmoil in France and Trade Tensions Impact Forex

Last week’s trading saw EUR/USD and GBP/USD reacting to a mix of political developments and global trade tensions. From France’s government reshuffle to U.S.- China tariff announcements, both pairs experienced sharp swings and notable volatility. Traders will continue to monitor key economic data this week as these factors shape the outlook for the major currencies.

EUR/USD Reacts to France Turmoil & US-China Trade

EURUSD closed last week’s trading session lower amid political and economic uncertainty in France. The pair hit a multi-month low of 1.1550 during the week. However, the downside momentum was unexpectedly halted, and EUR/USD sharply reversed to the upside after U.S. President Trump announced 100% tariffs on Chinese goods and canceled the planned meeting with China’s President Xi.

EURUSD Outlook – Germany’s Harmonized Index of Consumer Prices & U.S. Producer Price Index

This week, traders and investors will mainly focus on the outcome of France’s government reshuffle. President Macron reappointed PM Sebastian Lecornu, with promises to address political instability. Meanwhile, Trump’s tariffs on China are likely to influence USD price action. The reopening of the U.S. government continues to weigh on the Dollar, and any positive developments could trigger significant volatility.

On the economic calendar, Tuesday brings Germany’s Harmonized Index of Consumer Prices, expected to remain unchanged at 2.4%. On Thursday, the U.S. Producer Price Index is expected to rise to 0.4%, while retail sales are forecasted to decline to 0.4%.

Technically, the pair remains neutral after last week’s downside move. Short sellers have taken profits, and new long positions have emerged around 1.1588, targeting levels above 1.1700.

Position sentiment now s BUY 75% – SELL 25%

EURUSD chart, October 12, 2025. Source: TenTrade.com

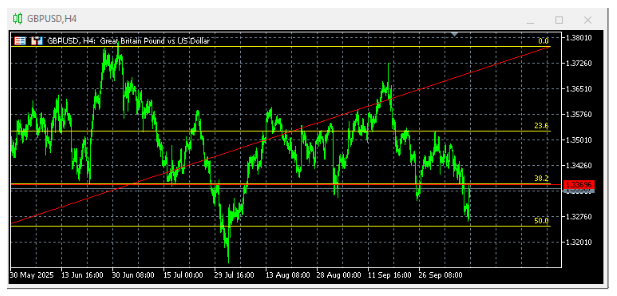

GBPUSD Outlook – UK ILO Unemployment Rate & GDP

GBPUSD closed last week’s trading session lower amid concerns over the U.S. government shutdown. The downside was unexpectedly halted, and pair sharply reversed on the upside after U.S. President Trump announced 100% tariffs on Chinese goods and canceled the meeting with China’s President Xi.

This week, traders and investors will mainly focus on Trump’s tariffs on China. A light economic calendar may keep the pair trading around current levels.

On the economic calendar, Tuesday brings the UK ILO Unemployment Rate, expected to remain unchanged at 4.7%. On Thursday, UK Gross Domestic Product (GDP) is expected to rise to 0.2%, UK Manufacturing Production is expected to be higher at 0.3%, while the U.S. Producer Price Index is expected to come in higher by 0.4% and retail sales lower by 0.4%

Technically, the GBPUSD pair remains neutral after last week’s downside move. Short sellers have taken profits, and new long positions have emerged at 1.3369, targeting profits above 1.3500.

Position sentiment is now at BUY 75% – SELL 25%

GBPUSD chart, October 12, 2025. Source: TenTrade.com

Key Takeaways

-

EUR/USD: Hit 1.1550 low; reversed after Trump’s China tariffs.

-

GBP/USD: Reversed upside amid US shutdown concerns and tariffs.

-

Focus This Week: France reshuffle, US-China tariffs, US gov reopening.

-

Economic Events: Germany HICP 2.4%, UK GDP +0.2%, UK Manufacturing +0.3%, US PPI +0.4%, US Retail -0.4%.

-

Technical Outlook: Neutral; new long positions forming.

-

Sentiment: BUY 75% – SELL 25%.

Per un calendario economico più dettagliato, visitate il nostro calendario economico in tempo reale su:

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. CFDs are leveraged products. CFD trading may not be suitable for everyone and can result in losing all your invested capital, so please make sure that you fully understand the risks involved.