Week ahead September 26th – 30th

FUNDAMENTAL DAN TEKNIKAL EUR/USD

Pair closed last week’s trading session lower registering a multi decade new low. The pair suffered huge selling pressure on FED’s rate hike of 0.75% that was accompanied by better than expected US economic releases. On the other side the Euro is getting into trouble as the energy crisis deepens and Russia adding nuclear threads against the EU. It looks like the Euro is entering into an oversold territory without end. The economic releases are so badly deteriorated that signals of recession are becoming stronger and stronger every week.

As for this week market participants will mainly focus on many speeches during the week from both ECB’s Christine Laggard and FED’s Jerome Powell. Both banks are in the same fight against inflation. Although the ECB is facing a strong front wind, the recession, and this is keeping the central bank more careful on its rate hike decisions. On the other side the FED can do more rate hikes of 0.25% each without affecting negative the US economy. Geopolitical turmoil will be the major element that will create more downside pressure on Euro as Russia is poised to annex three Ukraine states this week. That means, if Ukraine will try to attack a Russian territory, Russia could use nuclear weapons on Ukraine and situation will get out of control in Europe.

On the economic calendar, we have on Monday, German IFO business climate pointing lower at 87.1 On Tuesday, US durable goods orders expected lower at -1.1% On Thursday, German Harmonized index of consumer prices expected higher at 9.8% and US gross domestic product to remain unchanged at -0.6% On Friday, German retail sales expected lower at -5.1% European HICP to remain unchanged at 9.1% and US Michigan consumer sentiment unchanged at 59.5

Technically the picture is negative after last week’s closed below 23.6% In this week’s trading session if pair fails to resume upside move and continues on the downside , will accelerate losses down to 0.9550. If pair manage to recover and close above (23.6%) could change the picture back to neutral and test next level of 1.0118 (38.2%). Our traders have stopped out all long positions after the pair broke below 0.9880 and now they are sitting on the side and waiting for new levels to enter. We are expecting new buyers around 0.9500 alternative if pair resumes upside we are expecting short sellers to appear at 1.0118

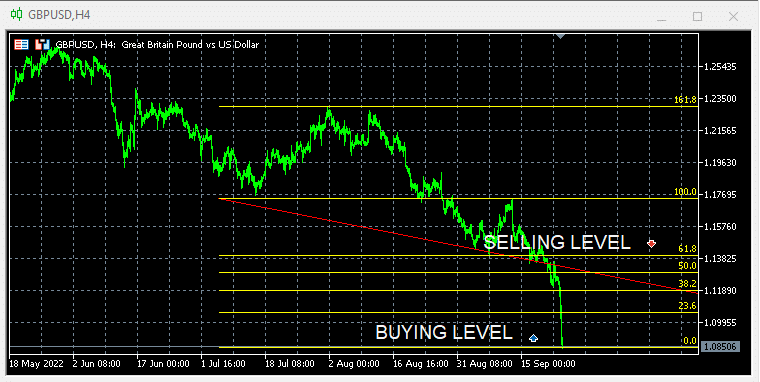

FUNDAMENTAL DAN TEKNIKAL GBP/USD

Pair closed last week’s trading session on extremely lower level never seen before. The FED hike rates by 0.75% and in combination with the better than expected economic releases from the US added more downside pressure to the pair. On the other side the BOE failed to deliver what market was expected. The 0.5% rate hike with the negative comments of BOE’s governor, confirming that the UK economy is officially in recession, was more than enough to accelerate losses.

As for this week market participants will focus on both central bank’s speeches. Traders should follow carefully what the central banks have to say and gather more information on the UK recession and how the central banks are planning to fight inflation while in the same time should avoid worsening their economic outlook.

On the economic calendar we have on Tuesday, US durable goods orders with expectations to be lower at -1.1% On Thursday, US gross domestic product to remain unchanged at -0.6% On Friday, UK gross domestic product to remain unchanged at -0.1 and US Michigan consumer sentiment unchanged at 59.5

Technically the pair is negative after last week’s new multi years lower registration. In this week’s trading session if pair manages to recover lost ground and close above 1.1050 (23.6%) we are expecting to test 1.1820 (38.2%) Alternatively a break below 0% could accelerate losses down to 1.0700 Our traders have stop out all their long positions after broke below 1.1300 and now are sitting on the side waiting for new levels. We are expecting new buyers at 1.0800 and short sellers at 1.1800

Untuk acara kalender ekonomi yang lebih terperinci, silakan kunjungi kalender ekonomi langsung kami di:

https://tentrade.com/economic-calendar/

*Materi ini tidak mengandung penawaran, atau permintaan untuk, transaksi dalam instrumen keuangan apa pun. TEN.TRADE tidak bertanggung jawab atas penggunaan apa pun yang mungkin dilakukan atas komentar-komentar ini dan atas segala konsekuensi yang diakibatkannya. Tidak ada perwakilan atau jaminan yang diberikan mengenai keakuratan atau kelengkapan informasi ini. Oleh karena itu, setiap orang yang bertindak berdasarkan informasi tersebut sepenuhnya atas risiko mereka sendiri. CFD adalah produk dengan leverage. Trading CFD mungkin tidak cocok untuk semua orang dan dapat mengakibatkan hilangnya semua modal yang Anda investasikan, jadi pastikan Anda memahami sepenuhnya risiko yang terlibat.