Minggu depan 29 Agustus - 2 September

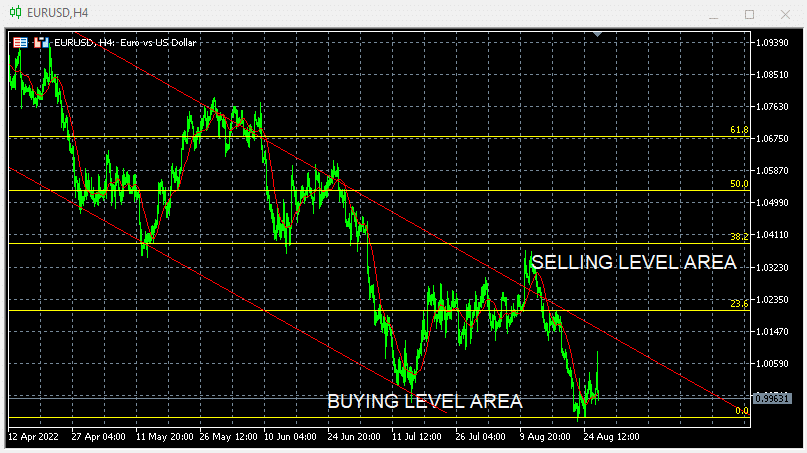

FUNDAMENTAL DAN TEKNIKAL EUR/USD

Pair closed last week’s trading session lower on hawkish comments from FED’s Powell. During the beginning of the week the pair manage to recover some lost ground with an attempt to break higher as some of EU’s economic indicators came out better than expected. Although recovery was not to last too far as FED’s Powell in his speech in Jackson Hole symposium reinforce last week’s comments that the central bank will hike rates by 0.75% in September and the rates will continue to be elevated until inflation will be down to normal levels. The energy crisis in the EU is here to stay as EU and Russia are keeping the gas flow low with both of them using the gas as levy for negotiations. The negative impact of EU suctions on Russia are felt in every sector in the EU and with the winter approaching, the energy crisis will be worsen and the recession in EU will be unavoidable.

As for this week all eyes will be on the US non farm payroll number. A better than expected release will boost US Dollar as it will help the FED’s decision to hike rates on the next meeting. The Inflation number in the EU will defy Euro’s next move. In others, the pair’s next move will depending on the economic releases during the week.

On the economic calendar we have on Tuesday, German Harmonized index of consumer prices pointing higher at 8,7%. On Wednesday, European HICP expected higher at 9% and US ADP employment expected to show an addition of 200K new jobs. On Thursday, German retail sales expected lower at -8% and US ISM manufacturing PMI lower at 52.6 On Friday US Non farm payroll to add 290K new jobs with the average hourly earning lower at 0.3%.

Technically the pair is negative after last week’s lower low registration. The pair is trading into a downtrend channel formation since the 15th of November 2021, formed by lower lows lower highs. As far as the downtrend formation is maintained, the picture will remain negative with lower lows in sight. In this week’s trading session if pair continues on the downside we are expecting to test 0.9850 level as lower low. Alternative if resumes upside, will retest the 1.0130 lower high level. A break above 23.6% is need to change the picture back to neutral and open the road for more recovery. Our traders are still long targeting profits above 1.1000 we are expecting more buyers on the way down and short sellers to appear above 1.0400

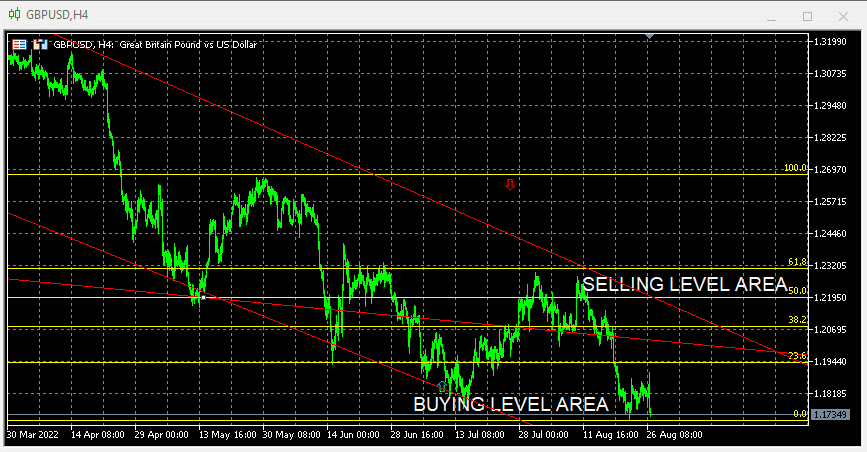

FUNDAMENTAL DAN TEKNIKAL EUR/USD

Pair closed last week’s trading session lower on FED’s Powell hawkish comments. The pair try to recover lost ground last week on the lack of any economic events. On Friday the speech of FED’s Powell shocked the traders after he said that the FED will continue hiking rates with he next one in September at 0.75%. The energy crisis and high inflation in the UK is adding pressure on BOE rate decision path and this generates a divergence between the two central banks. The FED on the one side pushing for rate hikes and the BOE on the other side siting and waiting for better economic outlook before the next rate hike in their effort to avoid entering into recession.

As for this week all eyes will be on the US non farm payroll number. A better than expected release will boost US Dollar as it will help the FED’s decision to hike rates on the next meeting. In the UK, the inflation is still a point to start for the BOE, although, given the recent deteriorated economic outlook, the central bank will focus in growth and employment before taking any decision on their rates in order to avoid dipping into recession.

On the economic calendar there is nothing from the UK, so, the pair will be in the faith of US Dollar and economic release from the US. On Wednesday, US ADP employment expected to show an addition of 200K new jobs. On Thursday, US ISM manufacturing PMI lower at 52.6 On Friday US Non farm payroll to add 290K new jobs with the average hourly earning lower at 0.3%.

Technically the pair is negative after the downside turn and closed just on the same lower level for 2022. In this week’s trading session if pair breaks below 1.1730 will open the road down to 1.1650 Alternative if pair resumes upside move we are expecting to retest 1.1944 A break above 23.6% is need to change the picture from negative to neutral and opening the road to 1.2060 Our traders are net long targeting profits around 1.2300 we are expecting more buyers on the way down and short sellers to appear above 1.2200

Untuk acara kalender ekonomi yang lebih terperinci, silakan kunjungi kalender ekonomi langsung kami di:

https://tentrade.com/economic-calendar/

*Materi ini tidak mengandung penawaran, atau permintaan untuk, transaksi dalam instrumen keuangan apa pun. TEN.TRADE tidak bertanggung jawab atas penggunaan apa pun yang mungkin dilakukan atas komentar-komentar ini dan atas segala konsekuensi yang diakibatkannya. Tidak ada perwakilan atau jaminan yang diberikan mengenai keakuratan atau kelengkapan informasi ini. Oleh karena itu, setiap orang yang bertindak berdasarkan informasi tersebut sepenuhnya atas risiko mereka sendiri. CFD adalah produk dengan leverage. Trading CFD mungkin tidak cocok untuk semua orang dan dapat mengakibatkan hilangnya semua modal yang Anda investasikan, jadi pastikan Anda memahami sepenuhnya risiko yang terlibat.