Week ahead October 10th – 14th

FUNDAMENTOS Y ASPECTOS TÉCNICOS DEL EUR/USD

Pair closed last week’s trading session lower after a failed attempt to recover more lost ground. The downside move was resulted from the better than expected non-farm payrolls, and hawkish comments from FED’s officials boosting rate hikes expectations. The better than expected economic releases from the US and the deteriorated economic outlook from EU is pushing the pair back to its multiyear lows that is also accompanied by strong signals that EU will be soon facing a new recession. Apart from the recession fears, a nuclear Armageddon was officially announced by US President Biden on a speech later this week. The unsustainable European economic war and suctions against Russia is now turning as boomerang on the EU and not only, is also under the thread of a nuclear war.

En cuanto a esta semana, los participantes en el mercado se centrarán principalmente en las actas del FOMC que se publicarán el miércoles. No se espera una subida de tipos en esta reunión, aunque las actas darán más pistas a los inversores y operadores sobre la futura trayectoria de la FED. La cifra de inflación en EE.UU. será el principal catalizador de cualquier movimiento importante en el par.

On the economic calendar, we have on Wednesday, FOMC minutes. On Thursday, German harmonized index of consumer prices expected to remain unchanged at 10.9%, US consumer price index expected higher at 6.5% On Friday, US retail sales expected lower at 0.2% and US Michigan consumer sentiment higher at 58.9

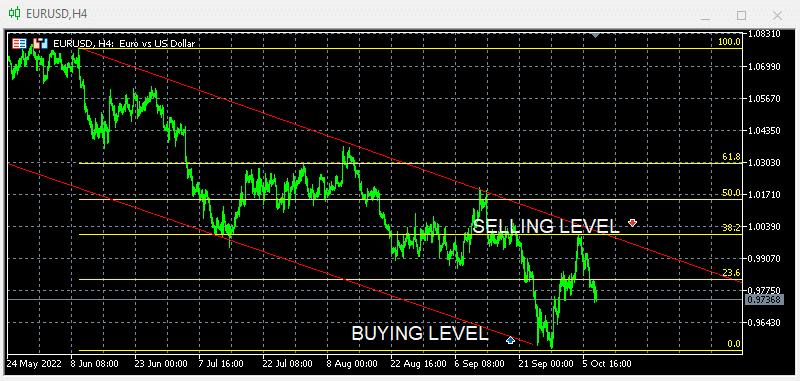

Technically the picture is negative after last week’s close below 23.6% In this week’s trading session if pair resumes upside and close above (23.6%) could change the picture back to neutral and re-test next level of 1.0030 (38.2%). Alternatively, if pair continues downside we are expecting to retest last low of 0.9550 (0%) We are expecting new buyers at 0.9550 targeting profits at 1.0000 Short sellers already appeared at 1.0030 targeting profits at 0.9550

FUNDAMENTOS Y ASPECTOS TÉCNICOS DEL GBP/USD

Pair closed last week’s trading session lower after an applaudable attempt to break higher on a magnificent thousand point recovery. Unfortunately, the pair did not manage to keep up recovering and turned down on hawkish FED comments and on better than expected non-farm payrolls in the US that have boosted expectations of more rate hikes ahead in the US. Thread of a nuclear Armageddon weighted negative on GBP and investors are turning into safe haven US Dollar.

As for this week market participants will focus on the FOMC minutes due to be released on Wednesday. No rate hike is expected at this meeting although the minutes will guide investors on what’s next with the central bank. The inflation number in the US and gross domestic number in the UK will be the most important catalyst behind any big move in the pair.

On the economic calendar we have on Tuesday, UK ILO employment to remain unchanged at 3.6% On Tuesday UK Gross domestic product expected lower at -0.1% UK manufacturing production lower at 0% and later the FOMC minutes will be released. On Thursday, US consumer price index expected higher at 6.5% On Friday, US retail sales expected lower at 0.2% and US Michigan consumer sentiment higher at 58.9

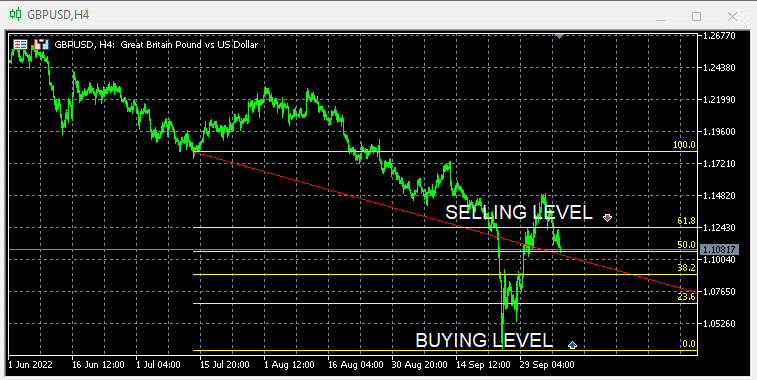

Technically the pair is positive as the pair closed above 50% level at 1.1081. In this week’s trading session if pair manages to resume recovery and close above 1.1273 (61.8%) will keep the overall picture positive and could open the road to full recovery up to 1.1800 Alternatively a break below 50% could accelerate losses down to 1.0900 We are expecting new buyers at 1.0700 and short sellers at 1.1800

Para conocer con más detalle los acontecimientos del calendario económico, visite nuestro calendario económico en directo en:

https://tentrade.com/economic-calendar/

*El material no contiene ninguna oferta ni solicitud de transacción de ningún instrumento financiero. TEN.TRADE no se hace responsable del uso que pueda hacerse de estos comentarios ni de las consecuencias que de ello se deriven. Sin representación no se ofrece garantía alguna en cuanto a la exactitud o integridad de esta información. Por consiguiente, toda persona que actúe sobre la base de la misma lo hace por su propia cuenta y riesgo. su propio riesgo. Los CFD son productos apalancados. Las operaciones con CFD pueden no ser adecuadas para todo el mundo y pueden dar lugar a la pérdida de todo el capital invertido.