Week Ahead July 8th – 12th

EURUSD pair closed last week’s trading session higher on disappointing US economic releases. US ISM manufacturing and ADP employment triggered a selloff in the pair, as investors and traders, are bracing for an interest rate cut in September. European investors are also bracing for this weekend’s French election results. The rise of Eurosceptic parties in Europe and the failure of France to form a majority parliament will weight negative on Euro with the possibility of downside market gap on Monday’s market opening.

As for this week, traders and investors will mainly focus on the French politics and what the new government formation will be. From the US the biggest catalyst will be the CPI number due to be released on Thursday. FED’s Powell will continue to testifies during next week giving the chance to investors and traders to gather more insides on what the FED’s future policy will be.

On the economic calendar we have on Thursday, German Harmonized index of consumer prices to remain steady at 2.5% and the US CPI pointing lower at 3.1% On Friday, German retail sales expected at -0.6%, US Producer price index higher at 2.5% and Michigan consumer sentiment higher at 68.5

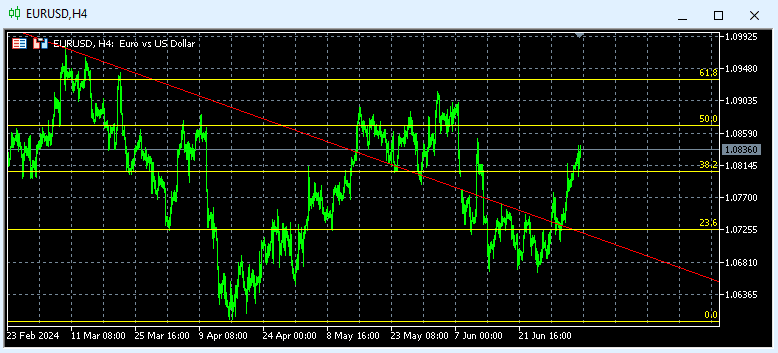

Technically the picture is neutral after last week’s close above (38.2%) at 1.0836 In this week’s trading session if pair trades on the upside will test 1.0870 If trades on the downside will test 1.0726 Our traders took profit their long positions ahead of French parliamentary election results. We are expecting new short positions at 1.0950 and new long positions at 1.0725

GBPUSD pair closed last week’s trading session higher on UK’s election results. Results were online with expectations and that gave to GBP a relief helping the pair to trade higher. The deteriorated US economic indicators and continuing selloff in US Dollar ahead of September’s interest rate cut expectations was another reason behind last week’s positive trading session.

As for this week, traders and investors will mainly focus on the FED’s Powell speech and US CPI number due to be released on Thursday. The lack of any UK economic events will keep the pair trading on US Dollar’s economic indicators and technical levels.

On the economic calendar we have on Tuesday, UK BRC like-for-like retail sales expected at 0.4% on Thursday, UK Gross domestic product pointing higher at 0.2% and US CPI pointing lower at 3.1% On Friday, US Producer price index higher at 2.5% and Michigan consumer sentiment higher at 68.5

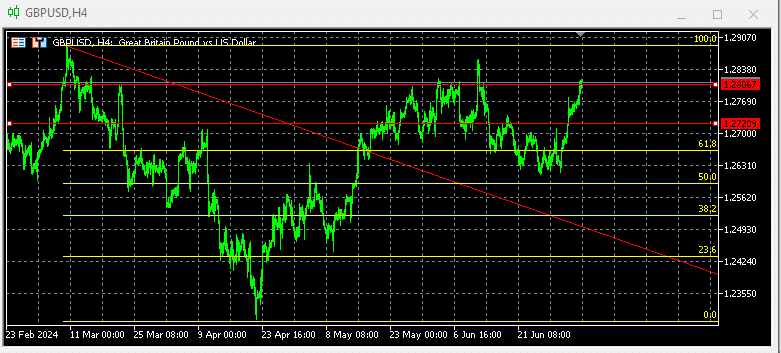

Technically the pair’s overall picture is positive after last week’s close above (61.8%) at 1.2806 As for this week, if pair trades on the upside, will test 1.2900 Alternative, if trades on the downside, will test 1.2665 (61.8%) Our traders are standing with short positions at 1.2800 and 1.2720 targeting profits at 1.2600 we are expecting more aggressive short positions on the way up and new long positions below 1.2600

Para conocer con más detalle los acontecimientos del calendario económico, visite nuestro calendario económico en directo en:

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. Sin representación no se ofrece garantía alguna en cuanto a la exactitud o integridad de esta información. Por consiguiente, toda persona que actúe sobre la base de la misma lo hace por su propia cuenta y riesgo. su propio riesgo. Los CFD son productos apalancados. Las operaciones con CFD pueden no ser adecuadas para todo el mundo y pueden dar lugar a la pérdida de todo el capital invertido.