Week Ahead July 22nd – 26th

EURUSD pair closed last week’s trading session lower on US Dollar recovery after last week’s selloff. Central banks’ diversion is widening as ECB’s dovish monetary policy and comments indicated that inflation persist and there will be no interest rate reduction in 2024. On the other hand, FED officials’ comments are highlighting once again the interest rate cut in September. ECB’s policy pushed the pair higher during the week, although, later retreated lower as investors and traders are no weighing the divergence between the two central banks.

As for this week, traders and investors will mainly focus on the economic indicators releases with the main one the US Personal consumption expenditures. As the PCE is FED’s key point for next interest rate decision this indicator will generate some volatility by the end of the week.

On the economic calendar we have on Monday, German retail sales pointing at -0.6% On Wednesday, European services PMI expected higher at 53 and US services PMI lower at 55 On Thursday, US Gross domestic product expected higher at 2% On Friday, US PCE index expected higher at 0.2%

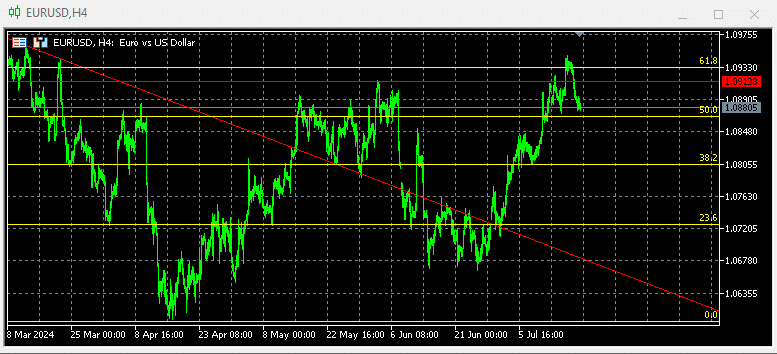

Technically the picture is positive after last week’s close above (50%) at 1.0880 In this week’s trading session if pair trades on the upside will re-test 1.0933 If trades on the downside will test 1.0868 (50%) A break out on either direction will move the price by at least 50 pips. Our traders stay with short positions at 1.0913 targeting profits at 1.0815 we are expecting more aggressive short positions on the way up and new long positions at 1.0725

GBPUSD pair closed last week’s trading session lower on some profit takings off the table. As we were expected the pair last week entered into overbought territory and a correction was around the corner. The pair retreated on US Dollar demand as investors and traders are weighing Central banks’ next interest rate decision.

As for this week, traders and investors will mainly focus on the economic indicators releases with the main one the US Personal consumption expenditures. As the PCE is FED’s key point for next interest rate decision this indicator will generate some volatility by the end of the week.

On the economic calendar we have on Wednesday, the UK Services PMI pointing at 52.1 and US services PMI lower at 55 On Thursday, US Gross domestic product expected higher at 2% On Friday, US PCE index expected higher at 0.2%

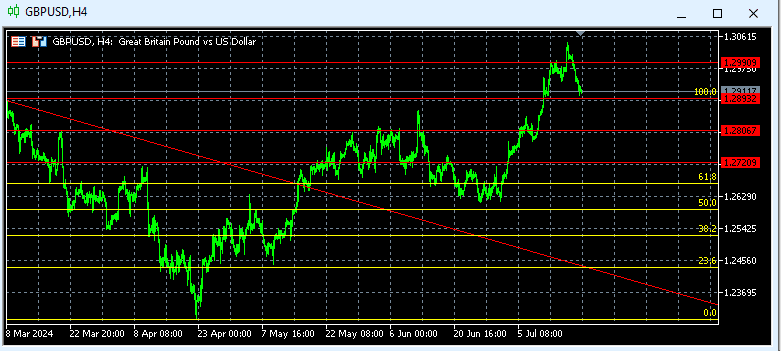

Technically the pair’s overall picture is positive after last week’s close above (100%) at 1.2911 As for this week, if pair trades on the upside, will test 1.3100 Alternative, if trades on the downside, will test 1.2893 (100%) Our traders are standing with short positions between 1.2990 and 1.2720 targeting profits at 1.2667 we are expecting more aggressive short positions on the way up and new long positions starting at 1.2667

Para conocer con más detalle los acontecimientos del calendario económico, visite nuestro calendario económico en directo en:

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. Sin representación no se ofrece garantía alguna en cuanto a la exactitud o integridad de esta información. Por consiguiente, toda persona que actúe sobre la base de la misma lo hace por su propia cuenta y riesgo. su propio riesgo. Los CFD son productos apalancados. Las operaciones con CFD pueden no ser adecuadas para todo el mundo y pueden dar lugar a la pérdida de todo el capital invertido.