Week ahead August 8th – 12th

FUNDAMENTOS Y ASPECTOS TÉCNICOS DEL EUR/USD

Pair closed last week’s trading session marginally lower after a very strong non-farm payroll number in the US. The number was taken positive from traders but not enough to convinced them that the FED will continue its aggressive rate hike policy. The pair continues to trade in tide range, hovering around multi years low and waiting for stronger data releases to resume either upside or downside. The lower than expected retail sales in both continents is another reason that keeps traders guessing whether we are entering into recession or not.

As for this week market participants will mainly focus on the Inflation numbers. Both central banks are now weighing their monetary policy mostly on the inflation number and on the economic releases outcomes. The month of August and the holiday mood for market participants, is unlikely to generate any huge moves. We are expecting the range to continue into the end of August.

On the economic calendar, we have on Wednesday, German Harmonized index of consumer prices to remain unchanged at 8.5% and US consumer price index to point higher at 6.1% On Friday, Michigan consumer sentiment expected higher at 52.3

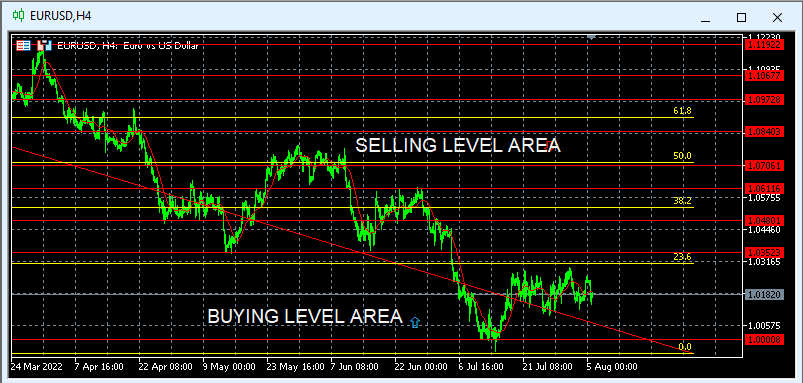

Technically the picture is negative after last week’s closed below 23.6% In this week’s trading session if pair fails to resume upside move and turns down, will retest 1.0000, if breaks below 1.0000 will accelerate losses down to 0.9900. If pair manage to recover and close above (23.6%) could change the picture back to neutral and test next level of 1.0530 (38.2%). Our traders are net 100% long with positions opened between 1.1350 to 1.0000 targeting profits above 1.1350 we are expecting more aggressive long positions on the way down. Alternative if pair continues trading on the upside, we are expecting short sellers to appear around 1.0530 (38.2%)

FUNDAMENTOS Y ASPECTOS TÉCNICOS DEL GBP/USD

Pair closed last week’s trading session lower on disappointing BOE rate hike. Markets were already pricing in the 0.5% hike, although pair was trading higher before the decision as traders were hoping to hear a 0.75% rate hike. The disappointing rate hike decision in combination with the better than expected non-farm payroll number in the US added downside pressure on the pair that resulted in reversal of all gained ground from the previous sessions.

As for this week market participants will focus on the inflation numbers and the economic releases from both sides. The better than expected inflation number in the US will add downside pressure on the pair as traders will start pricing in a new rate hike in September. From the UK point of view Gross domestic product will be the biggest catalyst for GBP.

On the economic calendar we have on Tuesday, BRC Like-for-Like retail sales pointing lower at -8.4% On Wednesday, US consumer price index expected higher at 6.1% On Friday, UK Gross domestic product expected lower at -0.2% Manufacturing production lower at 1.3% and in the US the Michigan consumer sentiment higher at 52.3

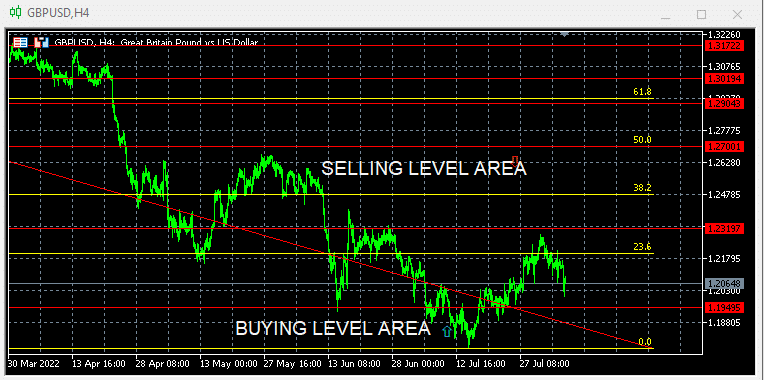

Technically the pair is negative after last week’s close below 23.6% In this week’s trading session if pair manages to resume on the upside, we are expecting to retest 1.2280 Alternatively if pair continues on the downside will retest 1.1800 A break below 0% could accelerate losses down to 1.1700 Our traders are net long 100% with positions opened between 1.3412 to 1.1950 targeting profits above 1.3400 We are expecting more aggressive buyers on the way down and short sellers to appear around 1.2625

Para conocer con más detalle los acontecimientos del calendario económico, visite nuestro calendario económico en directo en:

https://tentrade.com/economic-calendar/

*El material no contiene ninguna oferta ni solicitud de transacción de ningún instrumento financiero. TEN.TRADE no se hace responsable del uso que pueda hacerse de estos comentarios ni de las consecuencias que de ello se deriven. Sin representación no se ofrece garantía alguna en cuanto a la exactitud o integridad de esta información. Por consiguiente, toda persona que actúe sobre la base de la misma lo hace por su propia cuenta y riesgo. su propio riesgo. Los CFD son productos apalancados. Las operaciones con CFD pueden no ser adecuadas para todo el mundo y pueden dar lugar a la pérdida de todo el capital invertido.