All Eyes on Fed and BOC Meetings

EURUSD pair closed last week’s trading session marginally higher on ECB’s rate decision and mixed economic calendar from the US and EU. As it was widely expected ECB maintained interest rates unchanged without giving any signs for future rate cut expectations. The risks remain high as per ECB’s officials’ comments, thus, the rate will remain unchanged for longer. The higher than expected US CPI didn’t triggered any US Dollar buying demand confirming that the next Fed rate reduction is well priced in and well expected by investors.

Fed Rate Decision

As for this week, traders and investors will mainly focus on Fed rate decision due to be released on Wednesday. The Fed is expected to cut interest rates by 0.25%. The rate cut was well anticipated and priced-in over the last two weeks. We do not expect any huge price action to follow the decision unless the projections and press conference will signal another rate cut in the next meeting.

Economic Calendar – U.S. Retail Sales & EU Consumer Prices

The first key release on the economic calendar comes Tuesday, with U.S. retail sales expected to rise by 0.3%. On Wednesday, attention turns to Europe, where the Core Harmonized Index of Consumer Prices is forecast to hold steady at 2.3%.

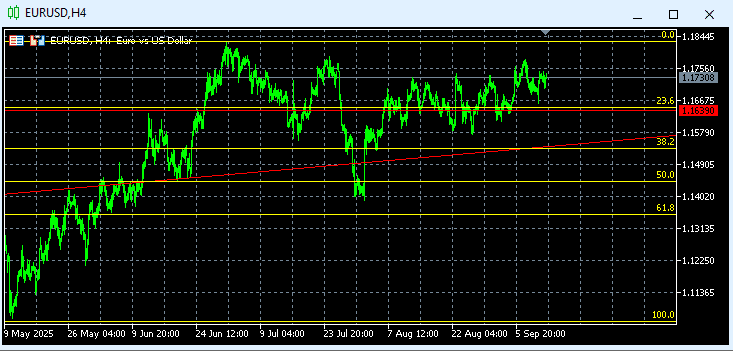

Technically the picture is positive after last week’s close above (23.6%) at 1.1730. In this week’s trading session, if the pair trades on the upside, it will test the 1.1850 level. A break out and close above 1,1850 will open the road for 1.1950. If trades go down, they will test the 1.1650 (23.6%) level. A break and close below 1.1650 will add downside pressure and test 1.1530. Our traders are standing with short positions at 1.1640 targeting profits at 1.1400. We anticipate more aggressive short positions as the price moves higher, with fresh long positions expected to emerge around the 1.1348 level.

EURUSD chart, September 14, 2025.Fuente: TenTrade.com

GBPUSD Closed the Week Higher

GBPUSD pair closed last week’s trading session higher on US Dollar’s softer trading session. The pair gained some ground from last week’s lower levels as investors and traders bought GBP ahead of this week’s BOE meeting. The mixed US economic releases weighted negatively on the US Dollar and helped the pair close the week higher.

Focus on BOE and Fed Meetings

As for this week, traders and investors will mainly focus on the BOE’s and Fed’s meetings and interest rate decisions. The Fed is expected to reduce interest rates by 0.25% and the BOE is expected to keep interest rates unchanged. The divergence, even though it is widely expected and priced-in, may not generate any significant volatility.

The GBPUSD in Action

On the economic calendar this week, Tuesday brings the UK ILO unemployment rate, expected to remain unchanged at 4.7%, alongside U.S. retail sales, which are forecast to rise by 0.3%. On Wednesday, attention turns to the UK CPI, anticipated to come in lower at 3.7%, as well as the release of the FOMC minutes and the U.S. interest rate decision. Thursday will be key for the UK, with the BOE’s policy meeting, interest rate decision, and a press conference. The week wraps up on Friday with UK retail sales, expected to show a 0.2% increase.

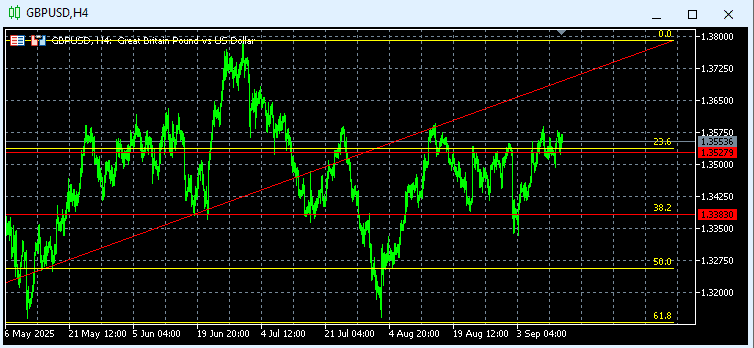

Technically the pair’s overall picture is positive after last week’s close above (23.6%) at 1.3553. As for this week, if the pair trades on the upside, it will test the 1.3630 level. A break and close above 1.3630 will open the road for 1.3800. Alternative, if trades go down they will test the 1.3372 (38.2%) level. A break and close below 1.3372 will open the road for 1.3255. Our traders are currently holding short positions from 1.3383 and 1.3527, targeting a profit level at 1.3200. We anticipate more aggressive short entries as the price moves higher, with fresh long positions expected to emerge around 1.3243.

GBPUSD chart, September 14, 2025.Fuente: TenTrade.com

Para conocer con más detalle los acontecimientos del calendario económico, visite nuestro calendario económico en directo en:

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. Sin representación no se ofrece garantía alguna en cuanto a la exactitud o integridad de esta información. Por consiguiente, toda persona que actúe sobre la base de la misma lo hace por su propia cuenta y riesgo. su propio riesgo. Los CFD son productos apalancados. Las operaciones con CFD pueden no ser adecuadas para todo el mundo y pueden dar lugar a la pérdida de todo el capital invertido.