Week Ahead April 22nd – 26th

EURUSD pair closed last week’s trading session unchanged as investors and traders are sitting on the side following escalation between Israel and Iran after last weekend’s Iranian strikes on Israel and after last Thursday’s Israel’s strike on Iran. Speeches from central bank’s officials were on line with their latest policy and did not impacted pair

As for this week, traders and investors will mainly focus on the geopolitical tensions in the middle east region and the economic calendar. We are expecting the pair to remain within the same range unless if the escalation in middle east will bring the two countries into full war.

On the economic calendar we have on Tuesday, the European composite PMI pointing at 50.3 and US services PMI at 51.7 On Wednesday, US durable goods orders expected at 1.4% On Thursday US gross domestic product expected lower at 2.1% On Friday US core personal consumption expenditures to remain unchanged at 0.3% and Michigan consumer sentiment unchanged at 77.9

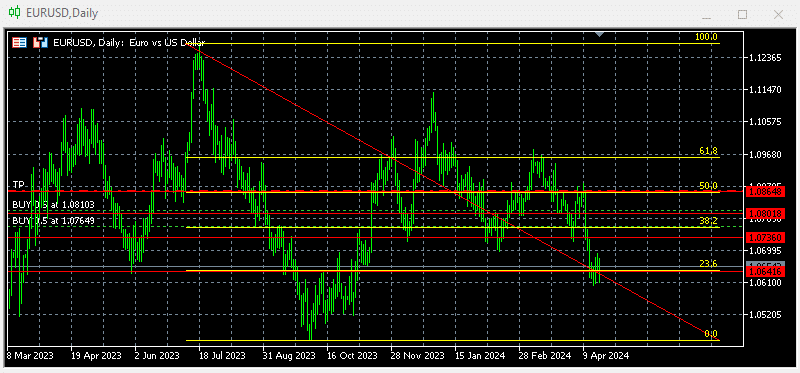

Technically the picture is negative after last week’s close just above (23.6%) at 1.0654 In this week’s trading session if pair trades on the downside will test 1.0600 If trades on the upside will retest 1.0766 Our traders standing firm with long positions between 1.0863 and 1.0640 targeting profits at 1.0900 We are expecting more aggressive long positions on the way down and new short positions above 1.0900

GBPUSD pair closed last week’s trading session lower amid Geopolitical tensions in the middle east, that push investors into safe heaven asset US Dollar. The softer UK CPI number added downside pressure on the pair as it will weight on BOE’s future interest rate decisions and might push the central bank for interest rate cut in 2024.

As for this week, traders and investors will mainly focus on the geopolitical tensions in the middle east and the economic calendar from both sides. Unless an escalation in the middle and a full-scale war between Israel and Iran, we are expecting the pair to recover some lost ground.

On the economic calendar we have on Tuesday, the UK composite PMI pointing at 52.8 and US services PMI at 51.7 On Wednesday, US durable goods orders expected at 1.4% On Thursday US gross domestic product expected lower at 2.1% On Friday UK Gfk consumer confidence at -21 US core personal consumption expenditures to remain unchanged at 0.3% and Michigan consumer sentiment unchanged at 77.9

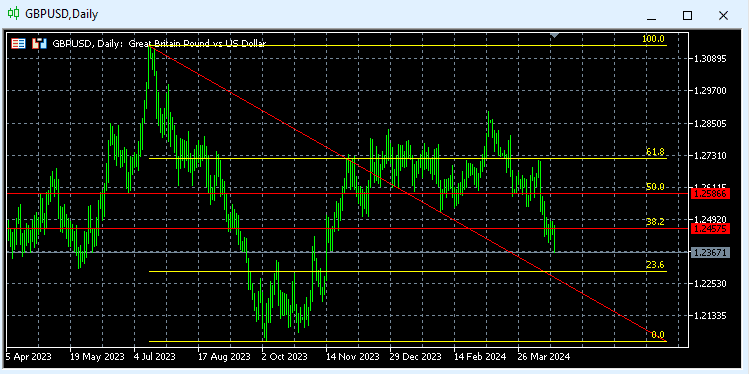

Technically the pair’s overall picture is negative after last week’s close below (38.2%) at 1.2366 As for this week, if pair trades on the upside, will test 1.2457 (38.2%) Alternative, if trades on the downside, will test 1.2300 (23.6%) Our traders are long between 1.2566 and 1.2457 targeting profits above 1.2800 We are expecting more aggressive long positions on the way down and new short sellers above 1.2700 targeting profits at 1.2600

For more detailed economic calendar events please visit our live economic calendar on:

https://tentrade.com/economic-calendar/

*The material does not contain an offer of, or solicitation for, a transaction in any financial instruments. TenTrade accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. CFDs are leveraged products. CFD trading may not be suitable for everyone and can result in losing all your invested capital, so please make sure that you fully understand the risks involved.