EUR/CHF: Are We Approaching a Key Technical Turning Point?

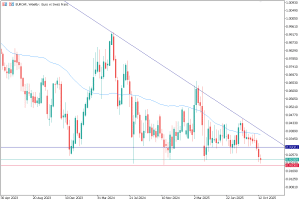

Over the past two years, the EUR/CHF pair has shown a remarkably consistent behaviour around the 0.93 level, which has repeatedly acted as dynamic support, triggering strong rebounds each time the price approached it. However, in recent months the strength of those rebounds has weakened, suggesting a gradual loss of bullish momentum.

This week, the pair has fallen below 0.93, moving towards the 0.92 area, which could prove decisive in determining the next major directional move in the market.

EURCHF chart, September 11, 2025. Source: TenTrade.com

Technical Overview

On the daily chart, the pair has been moving between 0.93 and 0.92, forming a narrow consolidation range that may be signaling a potential breakout setup.

If price remains below 0.93, that level could start acting as resistance, reinforcing the idea of a possible continuation of the bearish trend.

Conversely, a quick recovery back above 0.93 would temporarily invalidate this bearish bias and return the pair to its established range, where buyers may still find some ground to defend.

Fundamental & Structural Triggers

Beyond the technical setup, there are two important fundamental factors that could act as catalysts for a stronger move in EUR/CHF:

- Instability in Europe – Political uncertainty in major European economies (for example the evolving situation in France) could undermine the euro and increase safe-haven demand for the Swiss franc, putting pressure on EUR/CHF.

- Swiss National Bank’s (SNB) monetary policy – The SNB currently keeps its key policy rate at 0.00%, with some commentary suggesting that, while negative rates are not the baseline scenario, the option remains “on the table” if economic conditions deteriorate.

- Economists note the SNB’s hands may be somewhat tied given the franc’s strength, but even a tweak to excess‐reserve charges or forward guidance could have FX implications.

- In short, if the SNB signals further easing or intervenes in FX markets to weaken the franc, that could reduce franc strength—but if the SNB holds firm, the franc remains supported, which is bearish for EUR/CHF.

These fundamentals mean that a break below 0.92 would align with both technical vulnerability and a supportive macro backdrop for the franc.

Key Scenario to Watch

The price action around 0.92 will be crucial. A strong break below this level, supported by volume and triggered by one or both of the fundamental factors noted above, could open the door to new multi-year lows in EUR/CHF, with potential downside extension toward 0.91 or even lower.

However, if the 0.92 support holds, a short-term technical rebound within the current range cannot be ruled out.

Market Wrap-Up

The EUR/CHF pair is currently sitting at a highly significant technical and fundamental juncture. Market structure still favours the downside, but a confirmed daily close below 0.92, ideally supported by volume and/or fundamental pressure, would validate the deeper bearish continuation. Until then, patience and careful observation of price behaviour around these key levels remain the best strategy for market participants tracking this pair.